Bitcoin halving events, where the block reward for miners is cut in half, have historically impacted the cryptocurrency market. This analysis from Hyperloop Capital Insights delves into historical price data following past halvings and explores expert predictions for Bitcoin’s price trajectory after the upcoming 2024 halving.

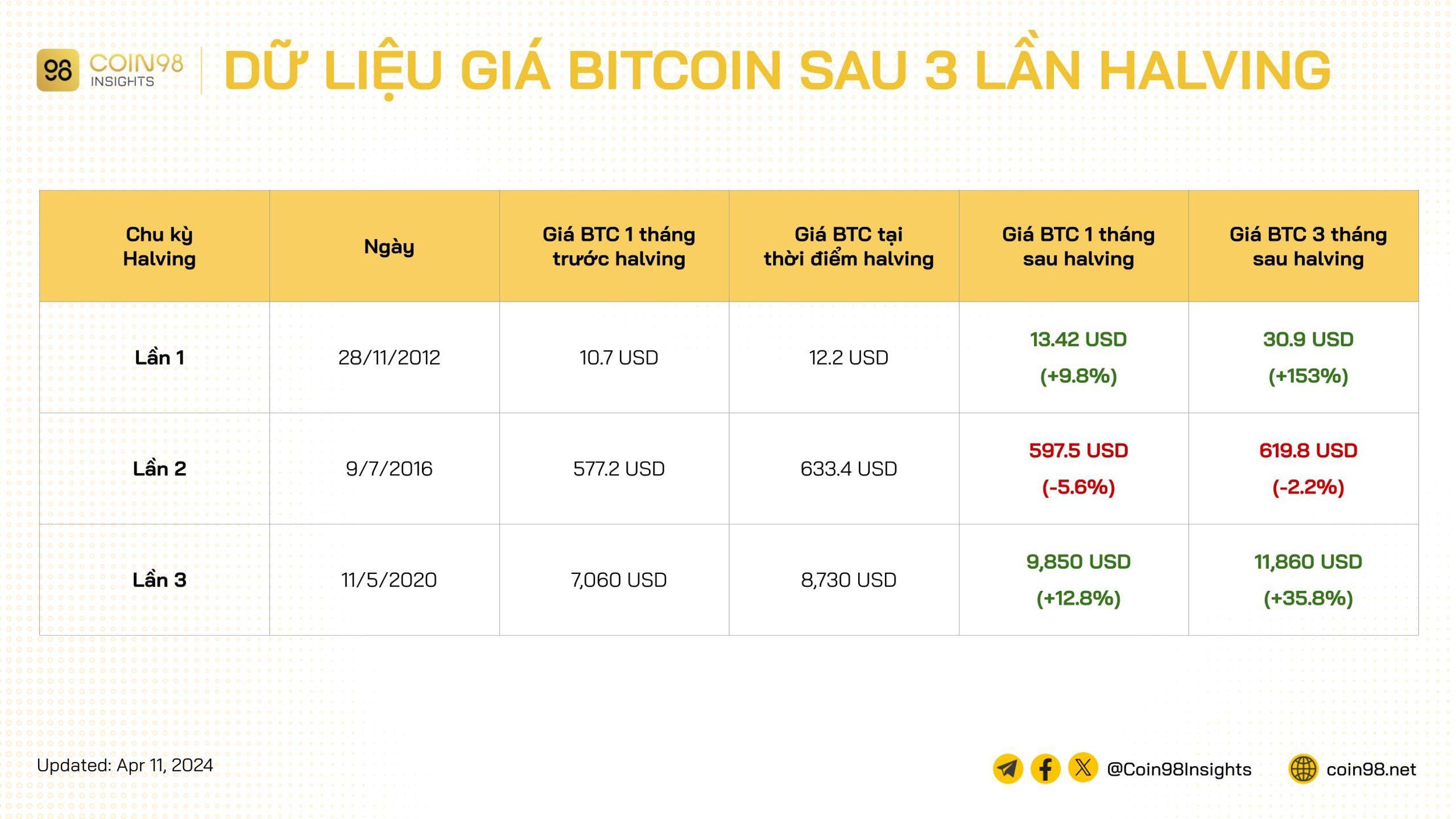

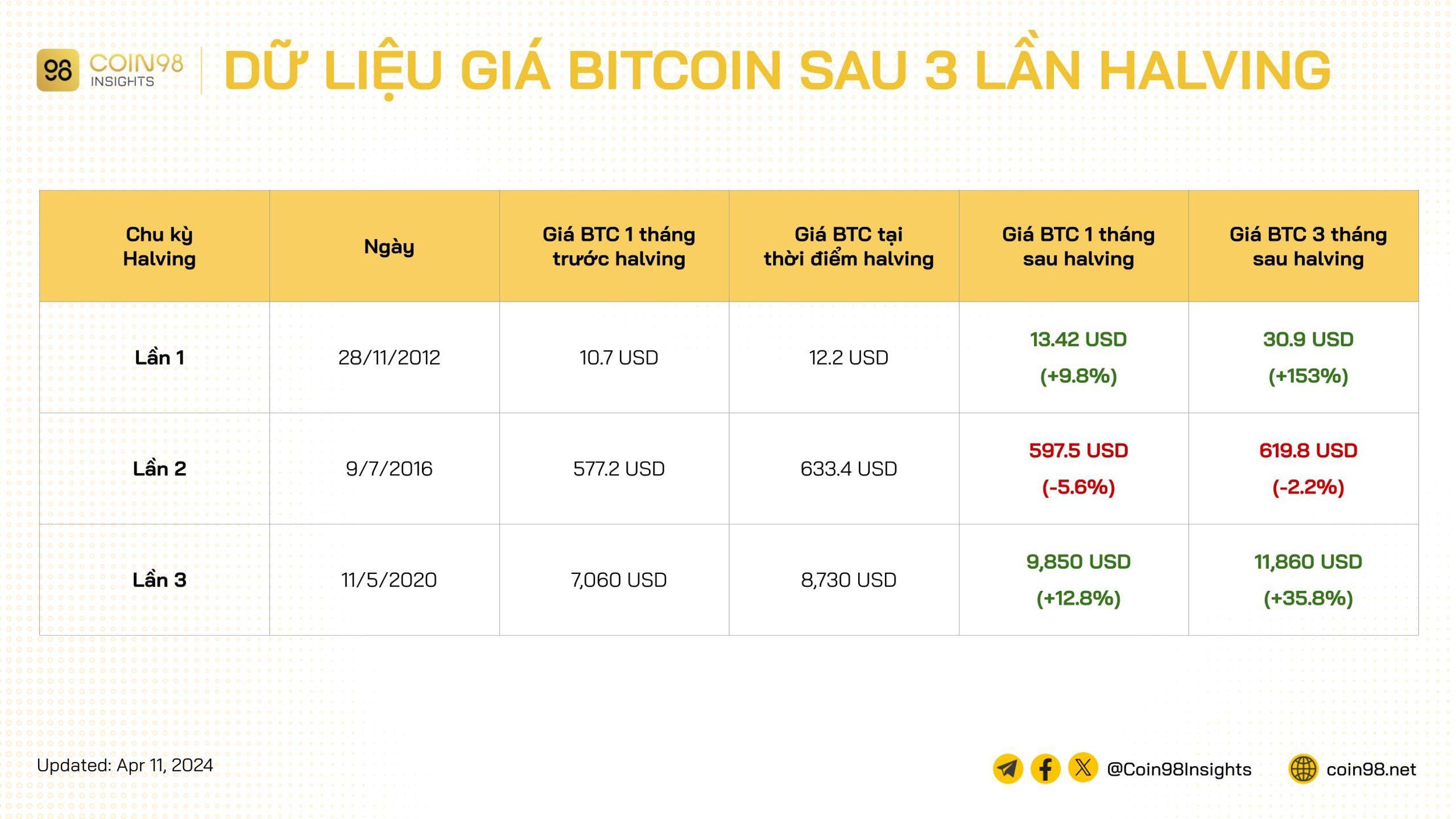

Table Content:

Historical Bitcoin Price Trends Following Halving Events

Bitcoin has undergone three halving events (2012, 2016, and 2020). Data reveals that in the first and third cycles, Bitcoin’s price experienced a slight initial increase followed by a more substantial surge approximately three months later. Following the 2016 halving, the price dipped, but the decline was relatively insignificant. While three halvings provide limited data for definitive conclusions, a pattern emerges: Bitcoin’s price tends to be lower one month prior to a halving and subsequently rallies. Long-term, Bitcoin has demonstrated robust growth, consistently reaching new all-time highs between halving cycles. Historically, market sentiment becomes bullish leading up to a halving, reinforcing its significance as a major event for the leading cryptocurrency.

Expert Predictions for Bitcoin’s Price After the 2024 Halving

Several prominent figures in the finance and cryptocurrency industries have offered their predictions for Bitcoin’s price following the 2024 halving.

Bullish Projections Dominate the Landscape

- Michael Novogratz (Galaxy Digital CEO): $125,000 – $150,000. Novogratz believes Bitcoin could reach $150,000 post-halving, citing increased institutional adoption and growing participation from a new generation of investors.

- Fred Thiel (Marathon Digital Holdings CEO): $120,000. Thiel emphasizes Bitcoin’s scarcity and the potential impact of a Bitcoin ETF approval as catalysts for price appreciation. He also highlights increasing institutional investment as a driver of demand.

- Tom Lee (Fundstrat Global Advisors): $150,000. Lee anticipates Bitcoin reaching $150,000 within 12-18 months post-halving, citing the combined influence of a Bitcoin ETF and the halving itself, along with Bitcoin’s inherent characteristics as a deflationary asset.

- Michael Saylor (MicroStrategy CEO): 10x Increase. Saylor predicts a tenfold increase in Bitcoin’s price, driven by institutional adoption and a shift away from smaller altcoins. This suggests a potential price target of around $350,000 based on Bitcoin’s price at the time of his statement.

More Conservative Estimates and Counterpoints

Other analysts, like those at Pantera Capital, offer more conservative estimates, projecting a post-halving price of $147,843 based on historical price trends. While the overall sentiment leans bullish, it’s important to remember that Bitcoin’s history is relatively short, and past performance is not indicative of future results.

Conclusion: Navigating the Uncertainties of Bitcoin’s Future

The upcoming Bitcoin halving is generating significant anticipation within the cryptocurrency community. While expert predictions paint a generally optimistic picture, investors should approach these forecasts with caution. The limited historical data and the inherent volatility of the cryptocurrency market necessitate a prudent investment strategy. Hyperloop Capital Insights recommends conducting thorough research and considering individual risk tolerance before making any investment decisions. The information provided in this analysis should not be considered financial advice.