AI agents are rapidly transforming the financial landscape, and the cryptocurrency market is no exception. Powered by sophisticated machine learning and deep learning algorithms, these automated software programs execute tasks on behalf of users, opening up a new era of efficiency and accessibility in the world of digital assets. At Hyperloop Capital Insights, we delve into the core functionalities and potential applications of crypto AI agents, providing you with the knowledge to navigate this evolving space.

Table Content:

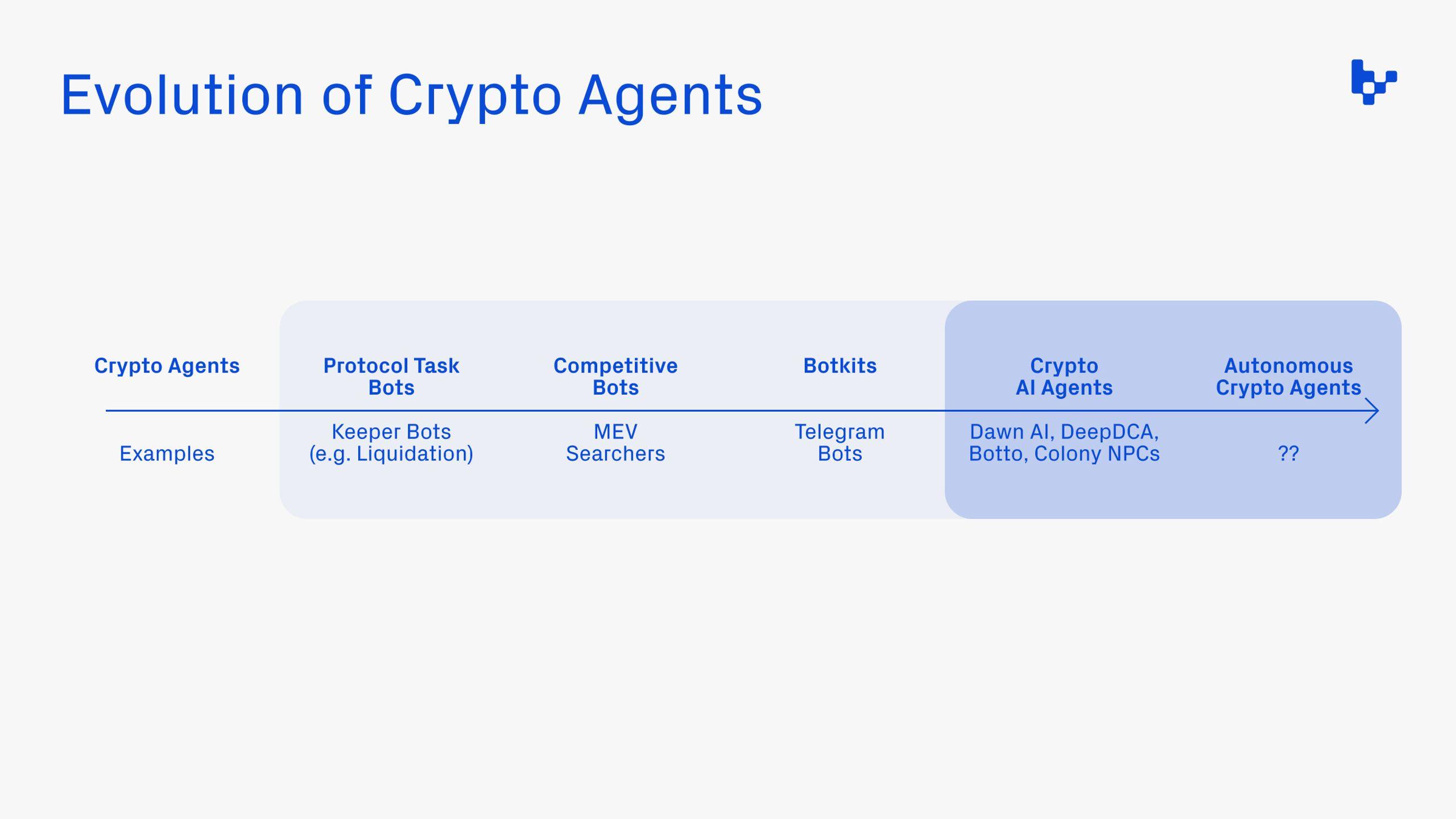

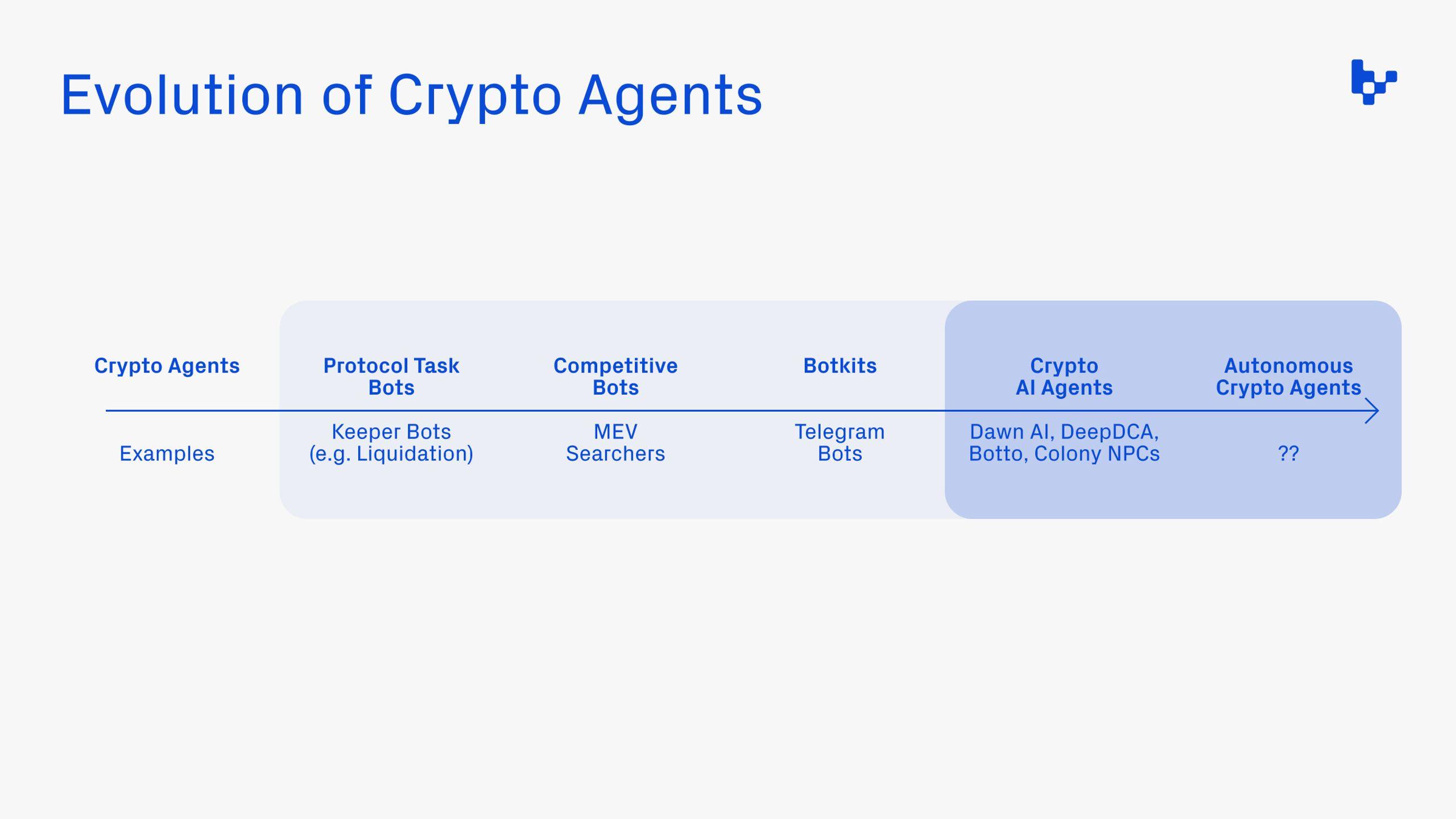

The Evolution of Crypto AgentsThe evolution of crypto agents. Source: Variant Fund

The Evolution of Crypto AgentsThe evolution of crypto agents. Source: Variant Fund

From Chatbots to Sophisticated Trading: Understanding Crypto AI Agent Applications

In their simplest form, crypto AI agents manifest as Telegram chatbots like Unibot and Banana Gun. However, their capabilities extend far beyond basic communication. These agents can also function as MEV bots (exploiting price discrepancies for profit) and Market Maker bots (providing liquidity to the market). Looking ahead, we anticipate a surge in crypto AI agents capable of executing complex transactions like buying, selling, and swapping cryptocurrencies based on user instructions. Imagine simply telling your digital wallet to “Buy $100 worth of Bitcoin” and having the AI agent seamlessly execute the trade.

Beyond transactional tasks, crypto AI agents possess the potential to revolutionize investment strategies. Their ability to analyze market trends and conduct independent research empowers them to make informed investment decisions on behalf of users. However, this autonomy also carries inherent risks. Incorrect analyses could lead to significant losses, underscoring the importance of understanding the capabilities and limitations of these agents.

Unlocking the Potential: Use Cases for Crypto AI Agents

Crypto AI agents address several key challenges faced by cryptocurrency users:

- Airdrop Optimization: Identifying and capitalizing on airdrop opportunities requires meticulous research and timely execution. AI agents can automate this process by analyzing historical data, predicting potential airdrops, and executing the necessary transactions.

- Memecoin Mania: The volatile world of memecoins demands rapid decision-making. AI agents can identify promising new memecoins with strong community backing and automatically invest, divesting when interest wanes.

- Personalized Investment Strategies: Navigating the vast cryptocurrency market can be overwhelming. AI agents can analyze the entire market landscape, tailoring investment recommendations to individual risk tolerances and financial goals.

Consider this hypothetical exchange:

- User: “Invest $5,000 from my wallet in crypto for one month, low risk, high liquidity. I might need access to the funds unexpectedly.”

- Crypto AI Agent: “Understood. I recommend allocating 50% to Bitcoin, 20% to Ethereum, 20% to C98, and 10% to Solana. I will continuously monitor these assets and adjust the portfolio as needed based on risk levels.”

- User: “Okay. Proceed.”

This illustrates the potential of AI agents to democratize crypto investing, making it accessible to a wider audience.

Key Players in the Crypto AI Agent Arena

The evolution of crypto AI agents has been marked by increasing complexity:

- AI-Powered Wallets: Wallets like DawnAI integrate AI agents to facilitate transactions and provide on-chain data analysis.

- GameFi Integration: Projects like Parallel Alpha’s Colony introduce AI-powered characters with individual wallets, fostering complex in-game economies.

- Automated DeFi Applications: DeFi apps leverage AI agents to automate tasks like dollar-cost averaging (DCA) based on predefined parameters or executing trades when gas fees reach specific thresholds.

Even established AI infrastructure providers like Ritual are entering the space, with Grenruf, an AI agent operating within Friend.tech, capable of executing trades based on user messages.

The Future of Crypto AI Agents: A Catalyst for Mass Adoption

While currently in their nascent stages, crypto AI agents are poised for significant growth. As AI infrastructure continues to mature, we can expect more sophisticated agents capable of handling complex tasks and interacting with users in more intuitive ways. This evolution could be the key to widespread cryptocurrency adoption, simplifying market participation and reshaping our interaction with finance. Furthermore, the rise of crypto AI agents is likely to fuel the growth of related projects in areas like decentralized physical infrastructure networks (DePIN) and GPU development. Hyperloop Capital Insights will continue to monitor these developments, providing timely analysis and insights to empower your investment decisions.