In June 2023, Optimism unveiled its vision for a unified network of Layer-2 solutions called the Superchain. This article analyzes the current development status of the Superchain and its potential impact on Optimism and the OP token.

Table Content:

Superchain Vision and Current Status

The Vision of Superchain

Optimism envisions the Superchain as a network of interconnected OP Chains, designed to enhance scalability and improve cross-chain user experience (UX). Ideally, the Superchain will enable seamless transactions between OP Chains, akin to operating on a single blockchain.

For instance, users could mint NFTs on the OP Mainnet using ETH tokens held on Base. Furthermore, upgrades across the entire Superchain and project funding would be governed by a single entity: the Optimism Collective.

The Optimism Collective is Optimism’s DAO governance system, comprising two entities: the Token House (governed by OP token holders) and the Citizen House (governed by badge holders).

OP Chains are built on the OP Stack, a governance-approved framework. Consequently, they are governed by Optimism and contribute revenue to the Optimism Collective. While OP Chains represent the future Superchain, the fully realized Superchain is not yet operational.

Superchain Development Progress

Number of L2s using OP StackNumber of L2s using OP Stack. Source: Optimism

Number of L2s using OP StackNumber of L2s using OP Stack. Source: Optimism

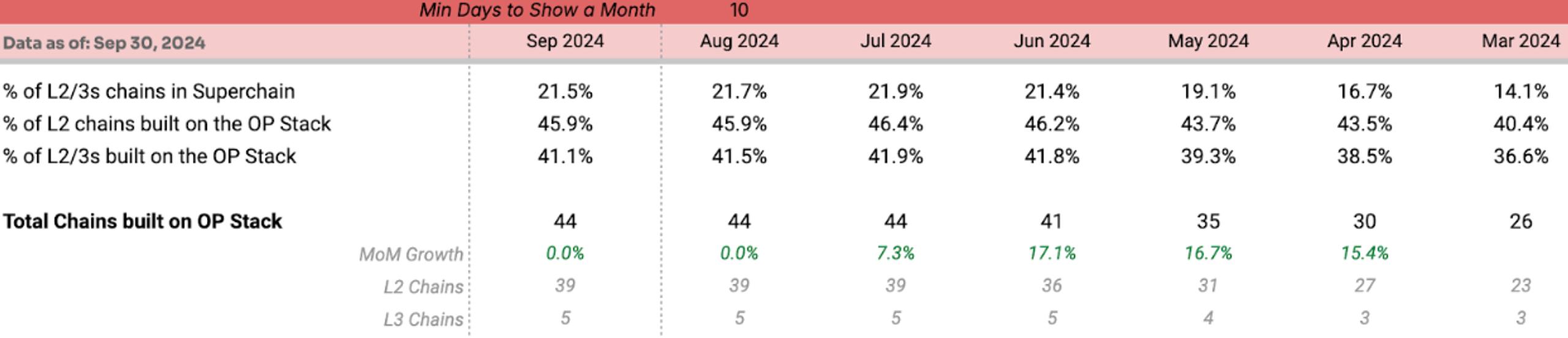

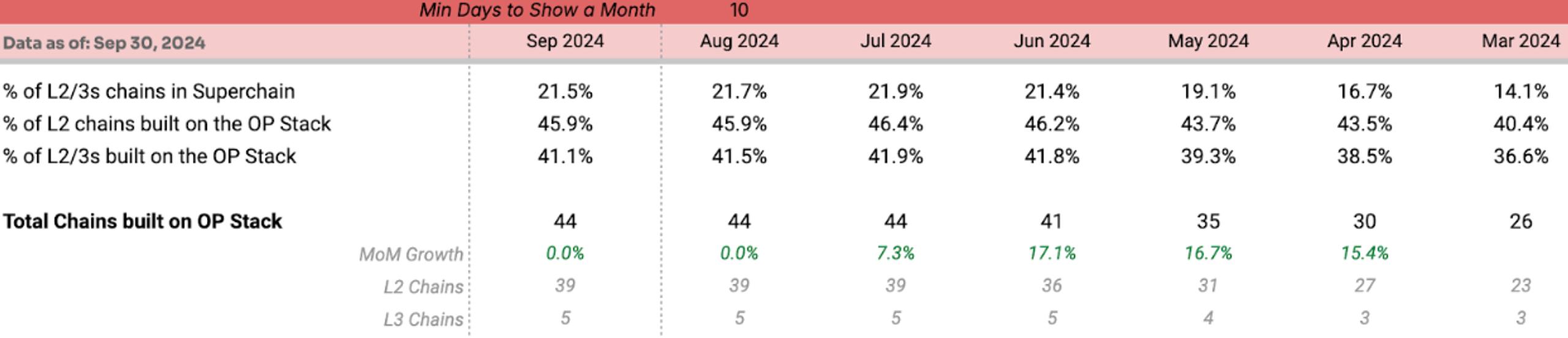

Over 45% of existing Layer-2 solutions (39 chains) are built using the OP Stack, significantly surpassing other SDK toolkits like ZkSync, Starknet, or Arbitrum.

The OP Stack’s popularity stems from the market’s preference for building L2s over L3s. Additionally, its MIT license agreement, compared to competitors’ Apache 2.0 license, grants developers greater freedom and flexibility, including regarding patent protections.

Number of OP Chains. Source: Optimism

Number of OP Chains. Source: Optimism

Beyond the growing number of chains utilizing the OP Stack, Superchain membership has increased since March 2024, with approximately 23 chains joining, driven by the network effect of Base and OP Mainnet. Currently, OP Chains operate as independent L2s but share the Optimism Collective’s governance mechanism.

The following sections analyze the Superchain’s impact on three key entities: the Optimism Collective, the OP Mainnet, and the OP token.

The Impact of Superchain on Optimism

As of October 2024, the Superchain has not yet fully launched. Therefore, the following analysis assesses its impact in two phases: current and projected future impact.

Optimism Collective

Current Impact: Increased Revenue for the Optimism Collective

Superchain Revenue Model. Source: Optimism

Superchain Revenue Model. Source: Optimism

OP Chains contribute either 15% of their profit or 2.5% of their revenue to the Optimism Collective, with the OP Mainnet contributing 100%.

Superchain Revenue. Source: Optimism

Superchain Revenue. Source: Optimism

By September 2024, the Superchain had contributed over 15,500 ETH (approximately $40 million) to the Optimism Collective. However, monthly contributions have decreased since March 2024.

Superchain Activity Metrics. Source: Artemis

Superchain Activity Metrics. Source: Artemis

This decline is attributed to reduced transaction fees on L2s following the Dencun upgrade, while transaction volumes haven’t increased sufficiently to compensate, leading to a revenue shortfall and decreased contributions to the Optimism Collective.

Optimism Collective Revenue Contributions. Source: Optimism

Optimism Collective Revenue Contributions. Source: Optimism

OP Mainnet and Base remain the largest contributors to the Optimism Collective, with OP Mainnet contributing more due to its 100% revenue sharing compared to Base’s 15%.

Future Impact: Potential Conflicts of Interest Regarding Retro Funding

Superchain Revenue Use Model. Source: Optimism

Superchain Revenue Use Model. Source: Optimism

Future revenue will be allocated for ecosystem development across the entire Superchain. The disparity in contributions – Base at over 27%, OP Mainnet at over 68%, and the remaining 21 chains at 4% – could potentially lead to conflicts of interest in Retro Funding programs.

Currently, no conflicts have been reported, as most Retro programs are primarily funded by OP Mainnet through OP token inflation. The shared revenue pool remains largely unused, with no concrete allocation mechanism established.

OP Mainnet

Future Impact: Leveraging Users and Liquidity Across Chains

Currently, the Superchain’s direct impact on OP Mainnet is inconclusive, as OP Chains operate independently. However, future projections are possible.

Superchain TVL and User DataSuperchain TVL and User Data. Source: Optimism

Superchain TVL and User DataSuperchain TVL and User Data. Source: Optimism

OP Mainnet currently boasts over $600 million in Total Value Locked (TVL) and 65,000 daily active wallets. Superchain interoperability could potentially grant OP Mainnet access to over $3.4 billion (TVL of Superchain apps) and over 1.3 million daily active wallets, facilitating ecosystem expansion.

dApps with TVL on SuperchainNumber of dApps with TVL on the Superchain. Source: Optimism

dApps with TVL on SuperchainNumber of dApps with TVL on the Superchain. Source: Optimism

Besides users and liquidity, OP Mainnet could onboard more dApps without extensive resource expenditure. Over 400 dApps with TVL exist across the Superchain, primarily operating on OP Mainnet, Base, and Zora.

Future Impact: Potential for Liquidity Conflicts Between Chains

Theoretically, Superchain participation allows OP Mainnet to tap into liquidity and users from other chains, accelerating ecosystem growth. Conversely, other chains could attract liquidity and users from OP Mainnet (a phenomenon known as Vampire Attack).

Liquidity Flow into Base and OP MainnetLiquidity Flow into Base and OP Mainnet. Source: Artemis

Liquidity Flow into Base and OP MainnetLiquidity Flow into Base and OP Mainnet. Source: Artemis

Currently, no significant Vampire Attack is observed between Base and OP Mainnet, as liquidity primarily flows from Ethereum, Arbitrum, and ZK Synz Era. However, this scenario could arise post-Superchain implementation.

Note: Data might be skewed due to funds potentially being withdrawn to ETH before transferring to L2s, although cross-chain transfers are less incentivized due to the 7-day confirmation period. Superchains tend to onboard Appchains for various use cases: SocialFi (Cyber, Zora), DeFi (Mode, Unichain), etc. This raises the question of which use cases will be prioritized on OP Mainnet.

OP Token

Current Impact: Limited Impact on OP Token

The Optimism Collective’s governance is bifurcated:

- Token House: Governance based on OP token holdings, with token holders voting on network upgrades, governance funds (5.5% of total OP supply), and inflation-related issues.

- Citizen House: Governance based on membership, with badge holders voting on Retro Public Goods funding (20% of total OP supply).

For the Superchain to significantly impact the OP token, it must influence the Token House governance.

OP Tokens Delegated for VotingNumber of OP Tokens Delegated for Voting. Source: Dune

OP Tokens Delegated for VotingNumber of OP Tokens Delegated for Voting. Source: Dune

Currently, over 95 million OP tokens are delegated for governance in the Token House, representing only around 7% of the circulating supply. This indicates low demand for OP tokens in governance.

In September 2024, the Chain Delegation Program, allocating 10 million idle OP tokens from the Governance Fund to up to 10 eligible OP Chains for governance participation, was approved with over 92% DAO approval. However, this allocation remains relatively small and doesn’t significantly impact market demand for OP tokens, as it’s merely a temporary allocation from existing OP tokens.

As previously mentioned, the Optimism Collective holds over 15,000 ETH (approximately $40 million) in unused contributions. Even if used to repurchase OP tokens for Retro Public Goods after Season 7, this represents only about 2% of OP’s current market capitalization, suggesting a negligible impact on OP token demand.

Future Impact: Potential Increase in OP Token Demand for Voting Rights

OP Token Allocation for Voting RepresentativesOP Token Allocation for Voting Representatives. Source: Dune

OP Token Allocation for Voting RepresentativesOP Token Allocation for Voting Representatives. Source: Dune

Since voting on individual chain development utilizes the Optimism Collective’s governance mechanism via OP tokens, OP Chains or protocols seeking greater voting power must acquire OP tokens on the secondary market (e.g., mattgov.eth and Anticapture Commission), potentially increasing OP token demand.

Conclusion

The Superchain is experiencing rapid development, attracting numerous dApps and chains. However, its impact on Optimism and the OP token remains unclear, primarily affecting revenue for the Optimism Collective, with limited impact on OP token demand.

A successful Superchain implementation could potentially unify liquidity, users, and dApps across chains, accelerating overall growth, but also introducing potential conflicts of interest.