Econometrics data reveals a correlation between Bitcoin’s price and investments in Bitcoin ETFs: for every $1 billion influx, Bitcoin’s price rises by approximately $2,300 (with a standard deviation of $3,600). With a cumulative $12.4 billion flowing into Bitcoin through spot Bitcoin ETFs, the price has surged by roughly $33,000, reaching an all-time high of $73,000 from a previous level of $40,000. Farside reports an average daily Bitcoin purchase volume of $141 million.

Table Content:

Bitcoin ETFs play a significant role in shaping Bitcoin’s demand and price fluctuations. While MicroStrategy and Grayscale averaged daily Bitcoin purchases of 386 and 959 respectively between 2020 and 2021, Bitcoin ETFs have averaged a staggering 2,593 Bitcoin purchases per day, according to Econometrics.

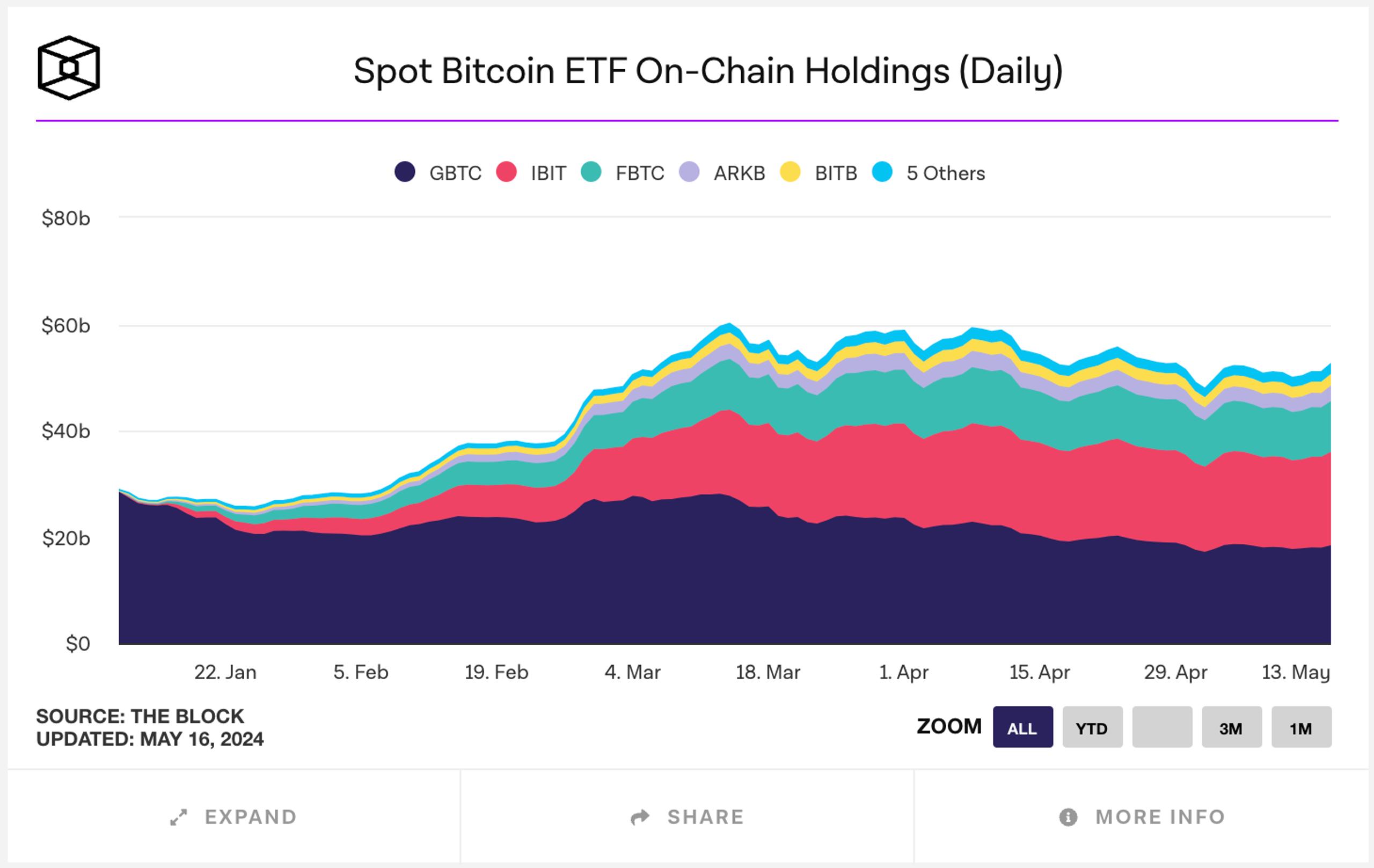

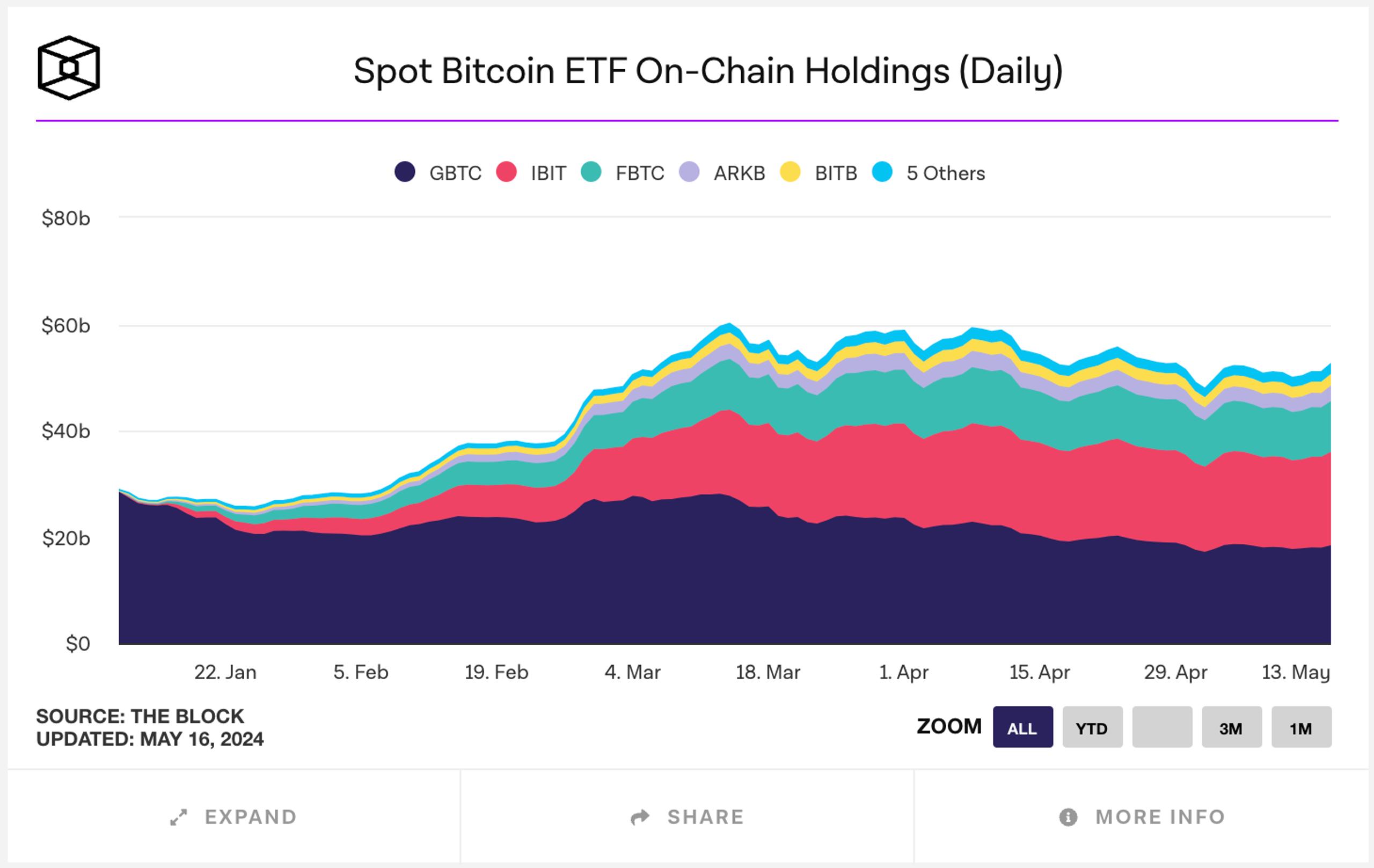

Currently, Bitcoin ETFs hold approximately 820,000 Bitcoin, valued at around $52.5 billion. Grayscale leads the pack with $18.42 billion, followed by BlackRock with $17.53 billion, Fidelity with $9.58 billion, and ARK 21Shares with $2.92 billion. This figure represents a slight decline from the $60 billion held in early March 2024, as reported by The Block.

Bitcoin Holdings of Bitcoin ETFsBitcoin Holdings of Spot Bitcoin ETFs. Source: The Block

Bitcoin Holdings of Bitcoin ETFsBitcoin Holdings of Spot Bitcoin ETFs. Source: The Block

The cumulative trading volume of Bitcoin ETFs has reached $261 billion, with a significant surge observed between March and May 2024. Notably, BlackRock’s Bitcoin ETF saw daily trading volumes exceeding $3 billion on several occasions in early March. BlackRock’s dominance extends beyond trading volume; it is poised to surpass Grayscale in Bitcoin holdings as the latter continues to reduce its Bitcoin reserves.

Grayscale’s Ongoing Bitcoin Divestment

Grayscale, a pioneer in incorporating Bitcoin into investment portfolios, launched the Grayscale Bitcoin Trust in September 2013. Between June 2020 and February 2021, Grayscale amassed 653,000 Bitcoin, starting with an initial accumulation of 365,000.

Following the approval of its Bitcoin ETF proposal, Grayscale converted the Grayscale Bitcoin Trust into the Grayscale Bitcoin Trust ETF. This transition led to a dramatic increase in daily trading volume, jumping from $200 million to $2.29 billion.

Grayscale Bitcoin Trust ETF Trading VolumeDaily Trading Volume of Grayscale Bitcoin Trust ETF. Source: The Block

Grayscale Bitcoin Trust ETF Trading VolumeDaily Trading Volume of Grayscale Bitcoin Trust ETF. Source: The Block

However, since the ETF launch, Grayscale has consistently sold off Bitcoin, divesting approximately 330,000 Bitcoins—over 50% of its peak holdings. This trend is clearly reflected in the downward trajectory of Grayscale’s Bitcoin holdings chart.

Total Bitcoin Holdings of Grayscale. Source: Coinglass

Total Bitcoin Holdings of Grayscale. Source: Coinglass

Grayscale has become the world’s largest Bitcoin ETF seller, offloading Bitcoin at a rate nearly matching the collective purchases of other Bitcoin ETFs.

Grayscale’s Continuous Bitcoin Sales. Source: Farside

Grayscale’s Continuous Bitcoin Sales. Source: Farside

Grayscale’s daily Bitcoin sales average around $250 million, with peak sales of $608 million and $618 million recorded on March 1st and March 19th, respectively. Currently, Grayscale holds approximately 289,000 Bitcoin, less than half its holdings at the beginning of the year.

One potential explanation for this divestment is the unwinding of speculative positions taken by investors who purchased Bitcoin from the Grayscale Bitcoin Trust before its ETF conversion, anticipating significant profits. JP Morgan suggests this $2.7 billion (including interest) could exit the Bitcoin market, potentially impacting Bitcoin’s price.

In contrast to Grayscale’s selling spree, BlackRock is actively accumulating Bitcoin.

BlackRock’s Bitcoin Accumulation Strategy

While Grayscale currently holds the largest share of Bitcoin (35.09%), followed by BlackRock (33.3%), Fidelity (18.31%), ARK 21Shares (5.62%), and Bitwise (4.3%), this landscape is rapidly changing due to BlackRock’s aggressive acquisition strategy. On March 5th and 12th, BlackRock purchased Bitcoin worth $788 million and $849 million, respectively.

Market Share of Bitcoin ETF HoldingsMarket Share of Bitcoin Holdings by ETFs. Source: The Block

Market Share of Bitcoin ETF HoldingsMarket Share of Bitcoin Holdings by ETFs. Source: The Block

With current holdings of 274,180 Bitcoin, BlackRock needs to acquire only 15,000 more to overtake Grayscale. This appears increasingly likely given Grayscale’s continued selling.

Consistent Positive Bitcoin Flow for BlackRock. Source: Coinglass

Consistent Positive Bitcoin Flow for BlackRock. Source: Coinglass

Beyond its accumulation strategy and positive cash flow, BlackRock commands a dominant 55.19% share of the Bitcoin spot ETF trading volume market, followed by Fidelity (18.92%), Grayscale (15.75%), and ARK 21Shares (4.75%).

Market Share of Bitcoin ETF Trading VolumeMarket Share of Trading Volume for Bitcoin ETFs. Source: The Block

Market Share of Bitcoin ETF Trading VolumeMarket Share of Trading Volume for Bitcoin ETFs. Source: The Block

BlackRock is on track to become the dominant force in the Bitcoin market, wielding significant influence through its substantial holdings and trading volume.

Bitcoin ETFs in Hong Kong

Currently, only three Bitcoin ETFs operate in Hong Kong: ChinaAMC, Bosera Hashkey, and Harvest. Their combined trading volume, approximately $49 million since their launch in late April 2024, pales in comparison to their US counterparts, according to Yahoo Finance.

Conclusion

Bitcoin ETFs have democratized Bitcoin access for traditional investors, facilitating a significant influx of capital into the cryptocurrency market. BlackRock, with its massive $10.5 trillion in assets under management, is poised to play a pivotal role in shaping the future of crypto.