Entering the world of cryptocurrency trading can seem daunting, but with careful preparation, you can navigate the market with confidence. Before making your first trade, it’s crucial to identify the specific coin or token you wish to purchase and determine which exchange offers it. Resources like CoinMarketCap and CoinGecko provide comprehensive information on various cryptocurrencies, including their current market price, trading volume, and available exchanges.

Table Content:

- Essential Preparations for Cryptocurrency Trading

- Bank Account, Mobile Payment App, or Digital Wallet

- Crypto Wallet for Secure Storage

- Trading on Centralized Exchanges (CEXs)

- Purchasing USDT with Fiat Currency

- Buying Cryptocurrencies with USDT on a CEX

- Trading on Decentralized Exchanges (DEXs)

- Step 1: Transferring Assets to Your Web3 Wallet

- Step 2: Trading on a DEX

- Understanding Cryptocurrency Trading Fees

- Frequently Asked Questions about Cryptocurrency Trading

- Is Cryptocurrency Trading Legal?

- What if a P2P Transaction on a CEX Fails?

- Do P2P Transactions Incur Fees?

- Should Beginners Use CEXs or DEXs?

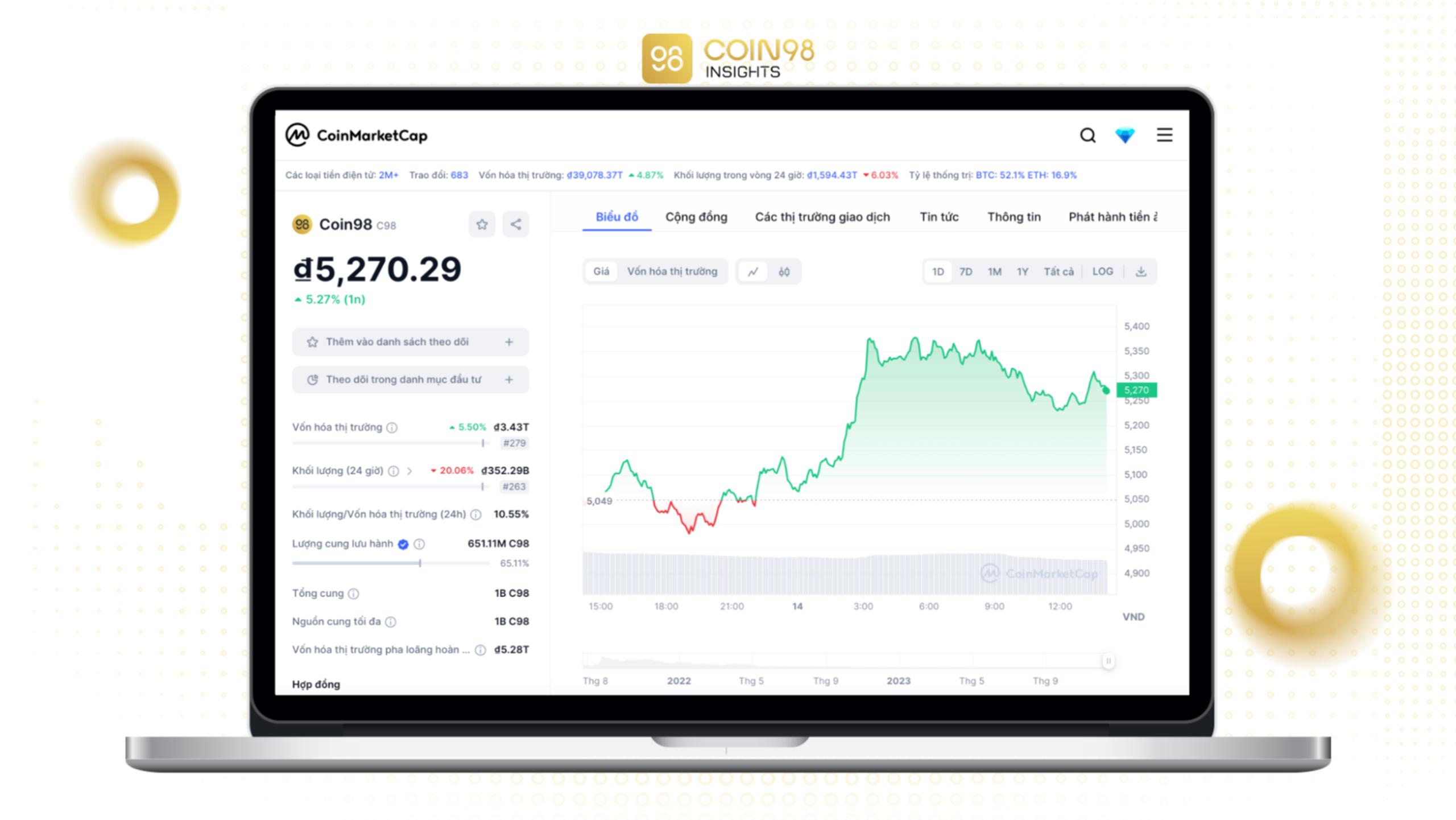

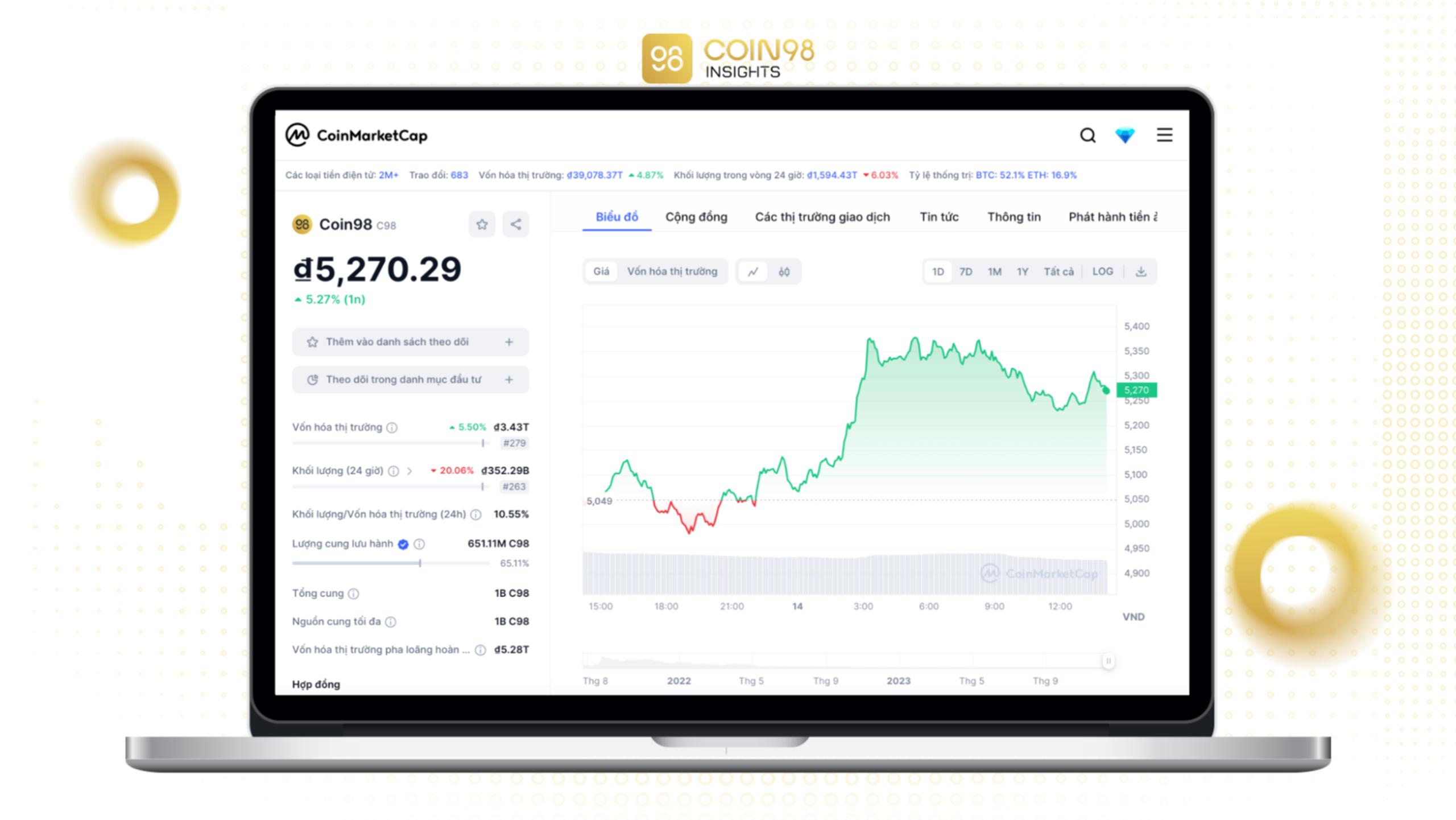

For instance, let’s say you want to buy C98 tokens. You can visit CoinMarketCap or CoinGecko, search for “C98”, and review its details.

Searching for C98 on CoinMarketCap

Searching for C98 on CoinMarketCap

Scroll down, and the platform will display a list of exchanges where C98 is actively traded. This article will use the centralized exchange (CEX) Binance and the decentralized exchange (DEX) PancakeSwap V3 as examples to illustrate the trading process.

Generally, the buying and selling processes on CEXs and DEXs are quite similar. Therefore, don’t be overly concerned about platform-specific differences.

Further Reading: Top Cryptocurrency Exchanges for Secure Trading

Beyond CEXs and DEXs, over-the-counter (OTC) trading, which involves direct transactions with individuals, is another option. However, exercise caution and only engage with reputable parties to avoid scams.

Once you’ve chosen your desired token, here’s what you need to prepare:

Essential Preparations for Cryptocurrency Trading

Bank Account, Mobile Payment App, or Digital Wallet

Participating in the cryptocurrency market requires a bank account or a digital wallet linked to a CEX. Major cryptocurrencies with high liquidity, such as USDT, BTC, ETH, and USDC, can typically be purchased directly using these methods.

Most centralized exchanges support connections with various banks and popular mobile payment apps like Apple Pay, Google Pay, and Samsung Pay. Ensure your chosen bank offers Internet or Mobile Banking for seamless online transactions.

Crypto Wallet for Secure Storage

Equipping yourself with one or two Web3 wallets is highly recommended for safeguarding your assets, participating in DeFi applications, and mitigating risks associated with CEX failures or closures. DEXs and dApps, such as lending/borrowing platforms and NFT marketplaces, require a Web3 wallet for connection.

Here are a few user-friendly wallet options:

MetaMask: A popular Web3 wallet known for its ease of use and integration with various dApps.

Trust Wallet: A mobile-focused wallet offering a user-friendly interface and support for a wide range of cryptocurrencies.

Trading on Centralized Exchanges (CEXs)

Purchasing USDT with Fiat Currency

USDT, a stablecoin pegged to the US dollar, provides price stability during transactions. Using stablecoins like USDT or USDC helps mitigate risks associated with volatile cryptocurrency price fluctuations.

Step 1: Create an account on a reputable CEX like Binance, following their specific instructions, and link your bank account. Ensure the bank account details match your identity verification documents. Discrepancies may hinder your ability to trade.

Step 2: Navigate to the “Wallet” section, usually found in the user interface, then select “Fiat and Spot” and click “Buy Crypto“. Choose your preferred payment method.

Step 3: Select USDT and enter the amount of fiat currency you wish to spend.

Step 4: Review the transaction details, including fees, and confirm the purchase.

Buying Cryptocurrencies with USDT on a CEX

After acquiring USDT, navigate to the “Markets” or “Trade” section and search for your desired cryptocurrency (e.g., C98).

Select the C98/USDT trading pair. You can typically choose between two order types:

Market Order: Executes immediately at the current market price.

Limit Order: Allows you to set a specific buy or sell price. The order will only execute when the market price reaches your specified limit.

Enter the desired amount of C98 and confirm the order. Selling follows a similar process, but you’ll choose “Sell” instead of “Buy”. CEXs typically charge small trading fees, so factor these into your calculations.

Trading on Decentralized Exchanges (DEXs)

Trading on DEXs requires transferring your assets to a Web3 wallet.

Step 1: Transferring Assets to Your Web3 Wallet

Withdraw your USDT from the CEX to your personal wallet. Each network has specific fees and withdrawal limits. Double-check the wallet address for accuracy. Sending funds to an incorrect address may result in permanent loss.

Withdrawing Crypto to a Wallet

Withdrawing Crypto to a Wallet

Step 2: Trading on a DEX

Connect your wallet to the chosen DEX (e.g., PancakeSwap). Navigate to the “Trade” or “Swap” section, select the desired trading pair, enter the amount, and confirm the transaction.

When using a DEX, consider:

Network Fees (Gas Fees): Vary depending on the blockchain.

Slippage (Price Impact): The difference between the expected price and the actual execution price. Higher slippage can result in less favorable trade outcomes.

Understanding Cryptocurrency Trading Fees

CEX fees typically range from 0.02% to 0.3% and include maker and taker fees. DEX fees include gas fees, platform fees, and liquidity provider (LP) fees.

Frequently Asked Questions about Cryptocurrency Trading

Is Cryptocurrency Trading Legal?

Cryptocurrency regulations vary by jurisdiction. Consult local laws and regulations for clarification.

What if a P2P Transaction on a CEX Fails?

Contact the exchange’s customer support to file a dispute.

Do P2P Transactions Incur Fees?

Most CEXs do not charge fees for P2P transactions.

Should Beginners Use CEXs or DEXs?

CEXs generally offer a more user-friendly experience for beginners due to their intuitive interfaces and higher liquidity. DEXs offer greater asset and platform diversity but often involve higher fees and a steeper learning curve.