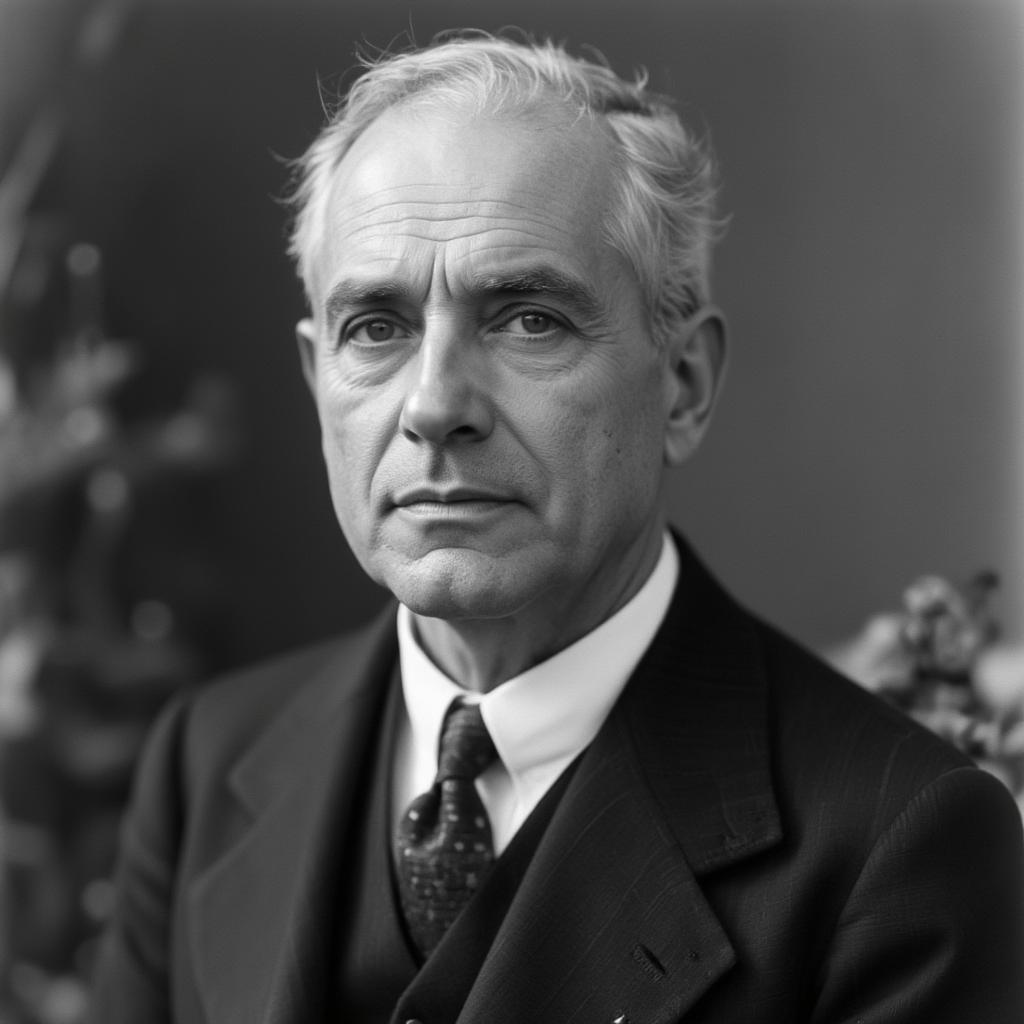

Irving Fisher, a prominent American economist, statistician, and inventor, significantly shaped financial theory in the early 20th century. His contributions to the understanding of interest rates, monetary policy, and capital markets continue to influence modern economics. Born in Saugerties, New York, in 1867, Fisher’s journey began with a strong foundation in mathematics and social sciences at Yale University. His doctoral dissertation, “Mathematical Investigations in the Theory of Value and Prices,” foreshadowed his lifelong dedication to exploring complex economic phenomena.

Fisher’s academic career at Yale spanned over four decades. He pioneered the development of numerous economic indices and models, notably the Fisher equation, which describes the relationship between nominal and real interest rates under inflation. This groundbreaking work revolutionized the way economists analyze interest rates and their impact on investment decisions. He also developed the concept of the “rate of return over cost,” a critical factor in evaluating the profitability of investments. This provided investors with a more sophisticated tool for assessing potential returns compared to traditional methods. His work on the quantity theory of money provided a framework for understanding the connection between money supply and price levels, further solidifying his influence on monetary economics.

Beyond the realm of academia, Fisher was a prolific writer and public intellectual. He authored numerous books, including “The Theory of Interest” and “The Purchasing Power of Money,” which are considered seminal works in financial economics. He advocated for various economic policies, notably a compensated dollar plan to stabilize purchasing power, showcasing his commitment to applying economic theories to real-world problems. His belief in the power of stable currency to foster economic growth drove his research and policy recommendations.

However, Fisher’s career was not without its setbacks. The 1929 stock market crash dealt a significant blow to his personal fortune and reputation. Despite this personal tragedy, he continued his research and writing, refining his theories and learning from the economic turmoil of the Great Depression. This period of adversity led to further development of his theories on debt deflation, which explored the harmful economic consequences of excessive debt and falling prices.

Portrait of Irving Fisher, American Economist

Portrait of Irving Fisher, American Economist

Fisher’s contributions extended beyond theoretical economics. He was a strong proponent of healthy living and a dedicated inventor, holding patents for various devices, including a visible card index system that became a precursor to the Rolodex. He also championed public health initiatives and was a vocal advocate for temperance. This multifaceted approach to life reflected his belief in the interconnectedness of various fields of study and their impact on societal well-being.

Fisher’s impact on financial thought remains profound. His work on interest rates, monetary policy, and the quantity theory of money continues to be studied and debated by economists today. His emphasis on the importance of understanding the real rate of return, accounting for inflation, and managing debt levels continues to be relevant for investors and policymakers. His theories provide a framework for analyzing economic fluctuations and formulating effective monetary policies.

Fisher’s legacy as a financial thought leader is undeniable. His contributions transformed the field of economics and provided invaluable insights into the dynamics of financial markets. His work continues to shape our understanding of investment, interest rates, and monetary policy, reminding us of the enduring impact of rigorous research and innovative thinking. His dedication to applying economic theory to real-world challenges continues to inspire economists and investors alike. His perseverance through personal and professional setbacks serves as a testament to his unwavering commitment to the pursuit of knowledge and the betterment of society.