On-chain data, the lifeblood of blockchain networks, provides a transparent and verifiable record of all activity. This data offers unparalleled insights into market trends, investor behavior, and the overall health of the crypto ecosystem. For savvy investors, understanding and interpreting on-chain data is no longer optional—it’s essential. This comprehensive guide explores the significance of on-chain analysis, its practical applications, and the essential tools for harnessing its power.

Table Content:

- What is On-Chain Data?

- The Power of On-Chain Analysis

- Accurate Market Insights

- Real-Time Behavior Tracking

- Predictive Capabilities

- Evaluating DeFi Platforms

- Considerations for On-Chain Analysis

- Case Studies: On-Chain Analysis in Action

- SushiSwap (SUSHI)

- My Neighbor Alice (ALICE)

- Keep3rV1 (KP3R)

- Essential On-Chain Analysis Tools

- Conclusion

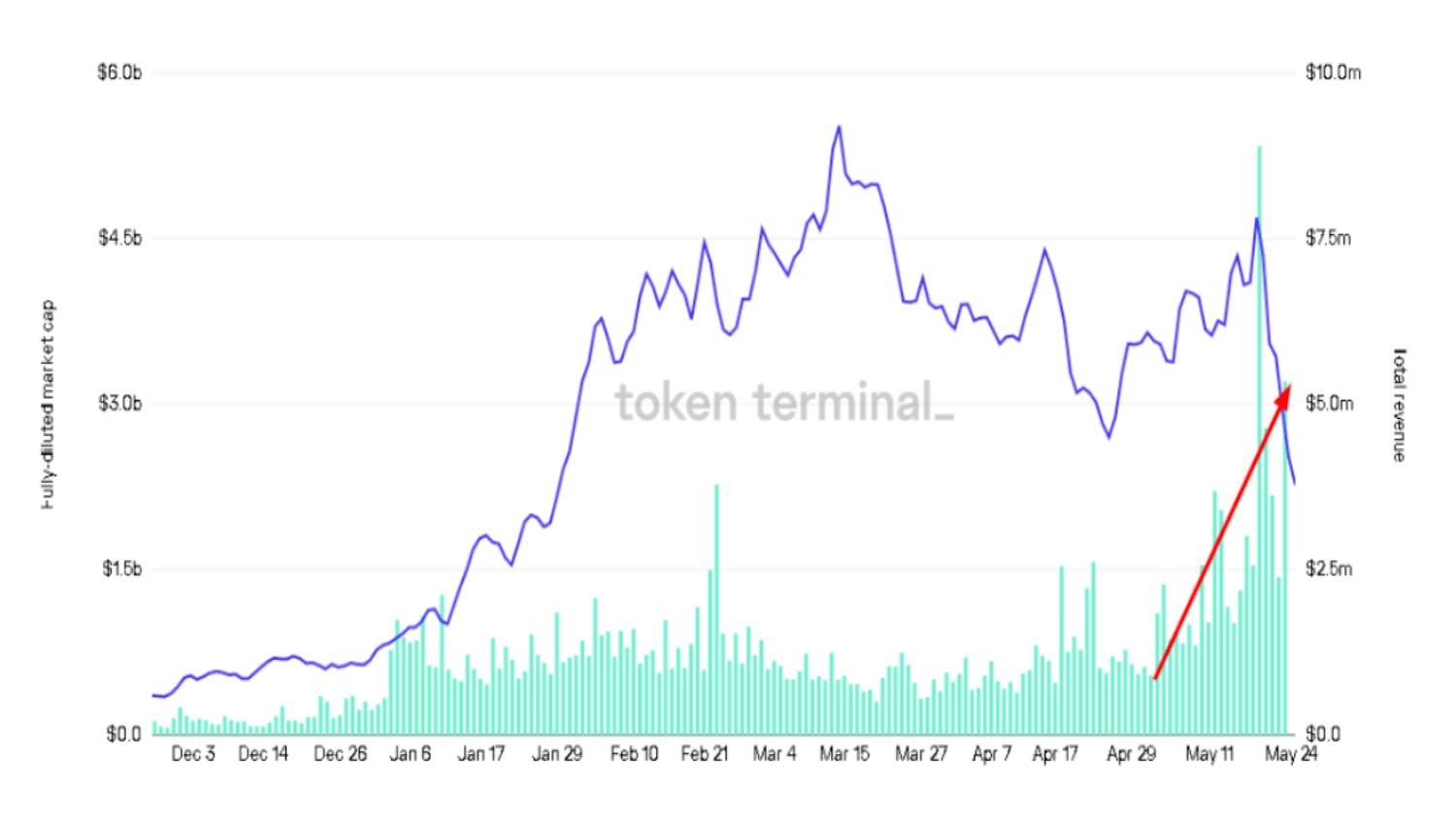

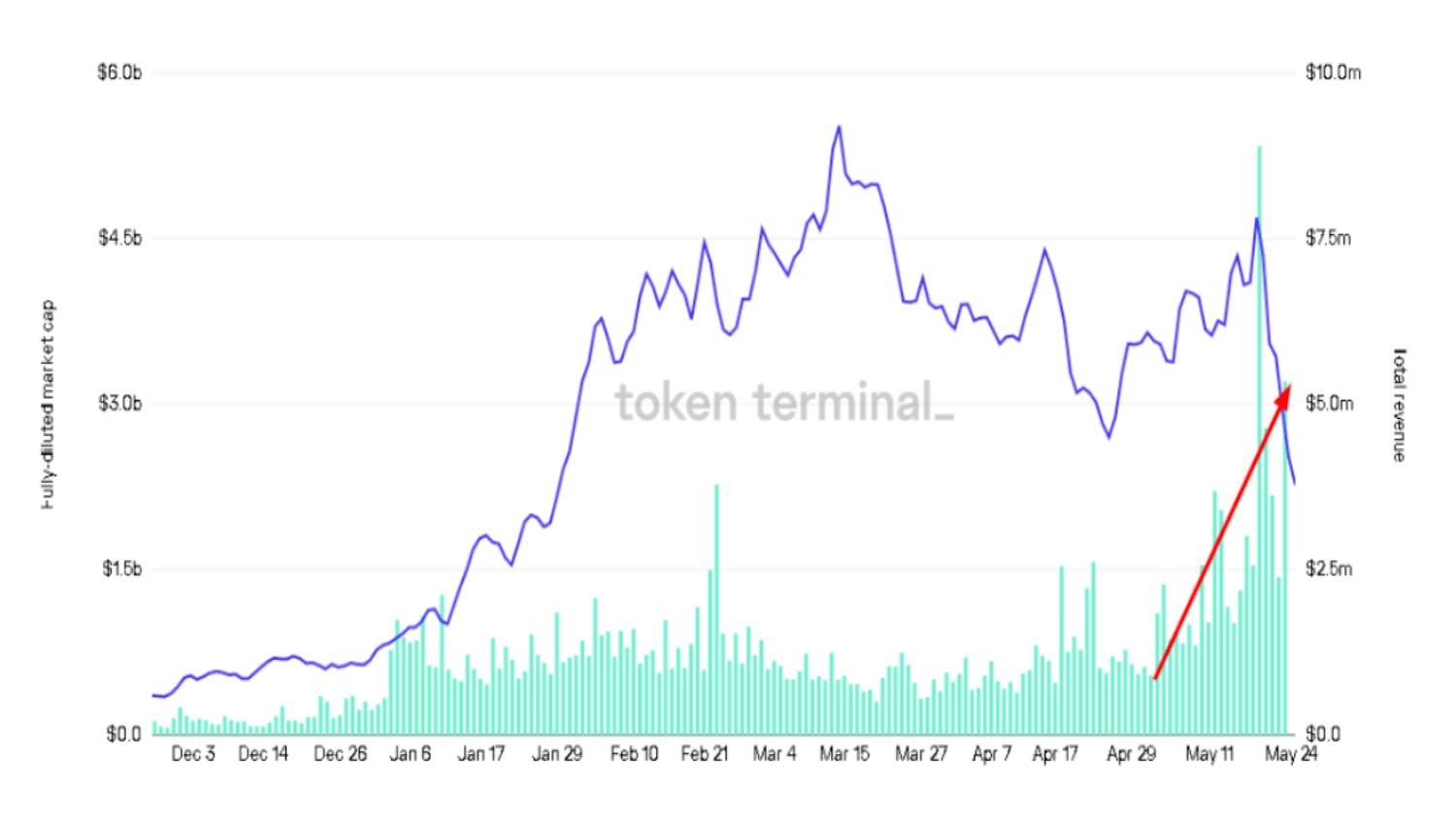

alt text for image 1: A graph showcasing the rising revenue of a decentralized exchange platform.

alt text for image 1: A graph showcasing the rising revenue of a decentralized exchange platform.

What is On-Chain Data?

On-chain data encompasses all information recorded on a blockchain, including:

- Block Data: Timestamps, gas fees, miner information, etc.

- Transaction Data: Wallet addresses of participants, transaction amounts, token types, etc.

- Smart Contract Interactions: Activities like adding liquidity, governance participation, etc.

Every action on a blockchain is verified by nodes and immutably added to the distributed ledger. This decentralized nature ensures data integrity, making on-chain data a reliable source of truth. Unlike manipulated charts or biased news, on-chain data offers an objective view of the crypto landscape.

The Power of On-Chain Analysis

Analyzing on-chain data provides crucial advantages for crypto investors:

Accurate Market Insights

On-chain data offers a transparent and unbiased view of market activity, providing investors with reliable information to base decisions on. This verifiable data eliminates the noise and misinformation often found in traditional markets.

Real-Time Behavior Tracking

By monitoring on-chain activity, investors can track the behavior of market participants, including large holders (“whales”). Understanding whale movements can provide valuable insights into potential market shifts.

alt text for image 2: A chart illustrating the distribution of a cryptocurrency across different exchanges.

alt text for image 2: A chart illustrating the distribution of a cryptocurrency across different exchanges.

Predictive Capabilities

Analyzing historical and real-time on-chain data allows for the identification of patterns and trends, enabling investors to anticipate potential market movements and make informed investment decisions. This proactive approach can provide a significant edge in the volatile crypto market. For example, observing accumulation by large wallets during a price dip may suggest a potential buying opportunity.

Evaluating DeFi Platforms

On-chain data is invaluable for assessing the performance of Decentralized Finance (DeFi) platforms. Metrics like trading volume, user activity, and total value locked (TVL) provide insights into a project’s health and potential for growth. Strong on-chain metrics often correlate with increased token value.

Considerations for On-Chain Analysis

While powerful, on-chain analysis requires careful consideration:

- Expertise and Experience: Interpreting on-chain data effectively requires a strong understanding of blockchain technology and market dynamics.

- Multiple Data Sources: Cross-referencing information from multiple reputable sources ensures accuracy and mitigates potential biases.

- Project Website Data: While valuable, data presented on project websites should be verified using independent blockchain explorers.

- Continuous Monitoring: Crypto markets are dynamic; therefore, continuous monitoring of on-chain data is essential for staying ahead of emerging trends.

Case Studies: On-Chain Analysis in Action

Several case studies demonstrate the practical application of on-chain analysis:

SushiSwap (SUSHI)

Analyzing SushiSwap’s on-chain data revealed a significant increase in revenue despite market volatility, highlighting the platform’s resilience. However, increased token selling pressure on centralized exchanges suggested caution for SUSHI holders.

alt text for image 3: A graph depicting the Total Value Locked (TVL) growth for a specific cryptocurrency project.

alt text for image 3: A graph depicting the Total Value Locked (TVL) growth for a specific cryptocurrency project.

My Neighbor Alice (ALICE)

On-chain analysis of ALICE indicated strong short-term demand driven by NFT land sales. However, a high concentration of trading volume on Binance signaled potential selling pressure and the need for cautious investment strategies.

alt text for image 4: Chart showing the token holdings of top holders for a specific cryptocurrency.

alt text for image 4: Chart showing the token holdings of top holders for a specific cryptocurrency.

Keep3rV1 (KP3R)

Analysis of KP3R’s on-chain data revealed a lack of developer engagement and a token model unlikely to drive significant price appreciation. This informed a decision to restructure investment capital allocated to KP3R.

alt text for image 5: A graph illustrating the price performance of a cryptocurrency over time.

alt text for image 5: A graph illustrating the price performance of a cryptocurrency over time.

Essential On-Chain Analysis Tools

Numerous tools facilitate on-chain analysis, categorized by their scope:

Macro Analysis (Market-Wide):

- The Block: Provides data on spot and futures trading volume, exchange flows, and stablecoin distribution.

- CryptoQuant: Offers in-depth on-chain metrics for Bitcoin and Ethereum, including exchange flows and whale activity.

- Glassnode: Specializes in Bitcoin on-chain data, providing a comprehensive view of network activity.

Micro Analysis (Project-Specific):

- Project Websites: Often provide valuable data, but it should be independently verified.

- Blockchain Explorers: (Etherscan, BscScan, etc.) Offer direct access to raw on-chain data for specific blockchains.

- Token Terminal: Provides key on-chain metrics for various crypto projects, facilitating performance comparisons.

- Nansen: Focuses on Ethereum-based token data, offering insights into smart money movements and emerging trends.

![]() alt text for image 6: A screenshot of the Coin98 Portfolio interface, showcasing its features for tracking cryptocurrency wallets and assets.

alt text for image 6: A screenshot of the Coin98 Portfolio interface, showcasing its features for tracking cryptocurrency wallets and assets.

Coin98 Portfolio:

This tool allows users to track wallet addresses across multiple chains, monitor portfolio value over time, and analyze whale activity. It provides a convenient platform for comprehensive portfolio management and on-chain analysis.

Conclusion

On-chain data analysis is an indispensable tool for navigating the complexities of the crypto market. By leveraging the transparency and immutability of blockchain data, investors gain a significant advantage in identifying opportunities, mitigating risks, and making informed investment decisions. Mastering on-chain analysis is crucial for achieving success in the evolving world of digital assets.