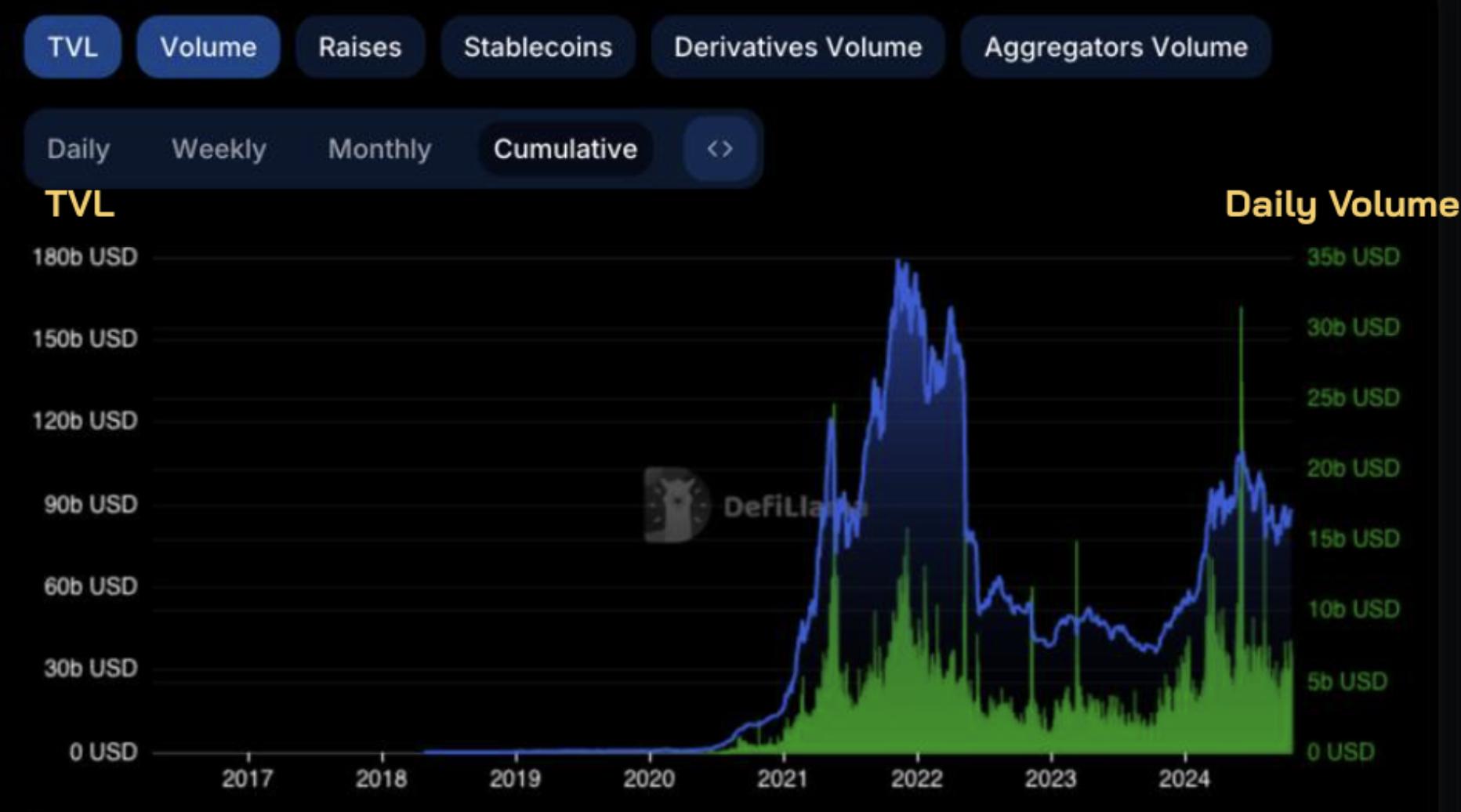

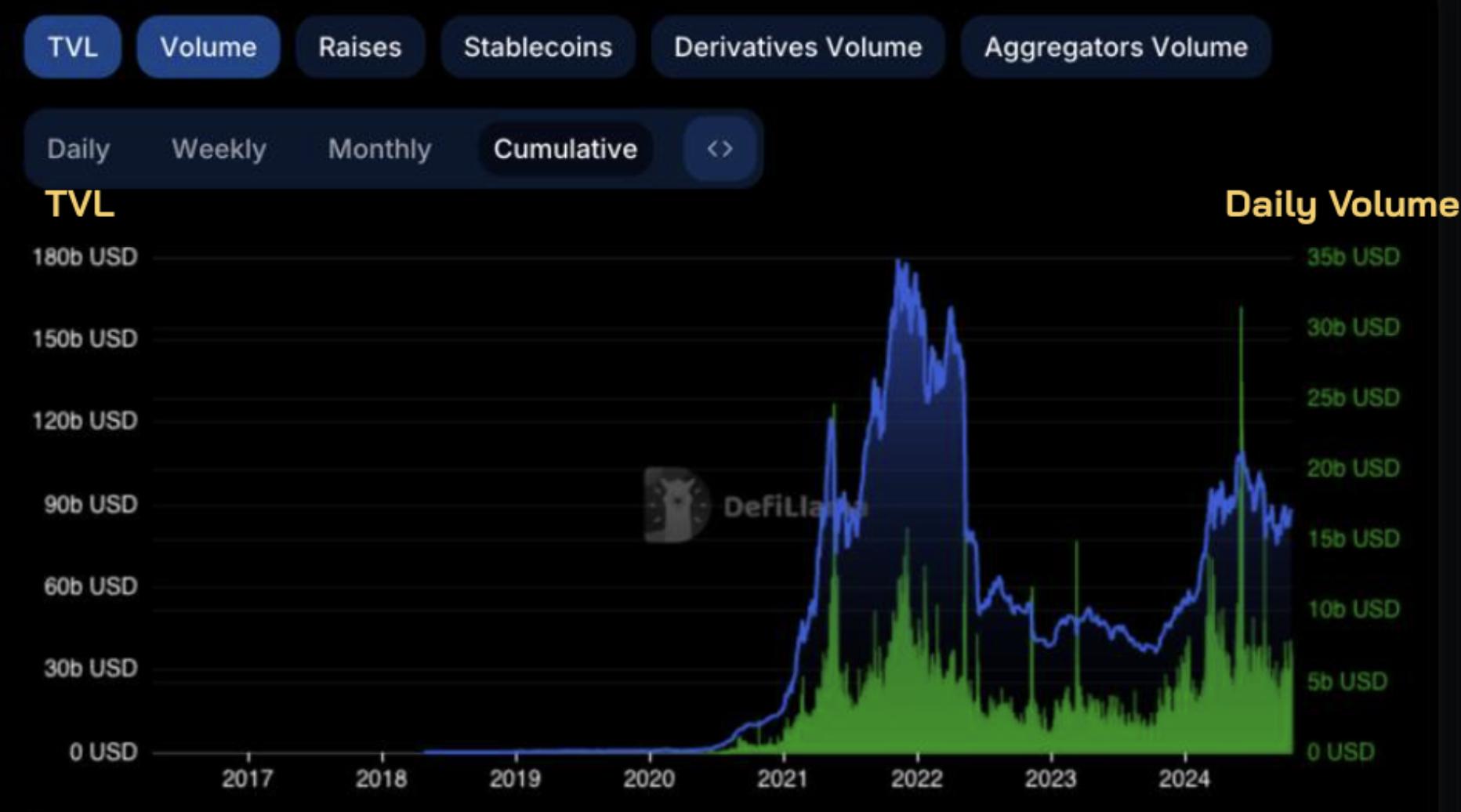

DeFi Total Value Locked (TVL)DeFi TVL and daily trading volume. Source: DefiLlama

DeFi Total Value Locked (TVL)DeFi TVL and daily trading volume. Source: DefiLlama

Table Content:

- Three Potential Catalysts for a DeFi Boom

- 1. Declining Interest Rates

- 2. Capital Influx from RWA, CEXs, and Bitcoin

- Real-World Assets (RWA)

- Centralized Exchanges (CEXs)

- Bitcoin

- 3. Proven Product-Market Fit

- Two Key Challenges for DeFi

- 1. Interest Rate Volatility and Liquidity Fragmentation

- 2. Unproven Efficacy of New Models

- Modular DeFi

- Restaking and BTCFi

- Conclusion

Despite DeFi’s Total Value Locked (TVL) hovering at around 60% of its all-time high due to token price fluctuations, daily trading volume has rebounded to its previous peak of $5-15 billion. This resurgence in activity suggests a renewed vibrancy within the decentralized finance (DeFi) market.

Daily Active Wallets in DeFiDaily active unique wallets. Source: a16zcrypto

Daily Active Wallets in DeFiDaily active unique wallets. Source: a16zcrypto

Data on daily active unique wallets reveals that DeFi commands a significant portion of the overall crypto market as of the end of September 2024. Note: Bot activity may influence these figures.

DeFi Revenue. Source: Token Terminal

DeFi Revenue. Source: Token Terminal

Revenue data further corroborates this trend. In Q2-Q3 2024, DeFi projects reached new revenue highs, surpassing even the levels seen during the DeFi Summer of 2021. This underscores DeFi’s enduring presence as a cornerstone of the crypto ecosystem. However, recent market attention has shifted towards other narratives like memecoins and AI, leading to a temporary decline in DeFi’s prominence.

Three Potential Catalysts for a DeFi Boom

1. Declining Interest Rates

Federal Reserve Interest Rates and Bitcoin PriceCorrelation between Fed Funds Rate, Treasury Yields, and Bitcoin Price. Source: FalconX Research

Federal Reserve Interest Rates and Bitcoin PriceCorrelation between Fed Funds Rate, Treasury Yields, and Bitcoin Price. Source: FalconX Research

Previous bull markets, coinciding with periods of aggressive interest rate cuts by the Federal Reserve, witnessed significant growth in DeFi. This correlation suggests two key benefits for DeFi in a low-interest-rate environment:

- Increased capital flow: Reduced yields in traditional investment vehicles like Treasury bills can drive capital towards higher-yielding alternatives like DeFi protocols.

- Greater market liquidity: Abundant capital facilitates venture investments in crypto tokens, potentially boosting yields and further attracting investors to DeFi.

DeFi’s sustained growth in a high-interest-rate environment in late 2023 indicates a strong potential for explosive growth as interest rates decline.

2. Capital Influx from RWA, CEXs, and Bitcoin

Real-World Assets (RWA)

RWA Market Capitalization. Source: Binance Research

RWA Market Capitalization. Source: Binance Research

The RWA sector reached a new peak market capitalization of over $12 billion by the end of August 2024, more than doubling its size compared to the same period in 2023. This growth is primarily driven by:

- Private Credit: Representing 75% ($9 billion) of the RWA market, this segment offers immense potential compared to the traditional private credit market (0.9%). Platforms like Centrifuge, Maple, and Goldfinch facilitate access to this burgeoning market.

- Tokenized Treasuries: Accounting for 17% ($2.2 billion), this sector involves platforms like Ondo, Securitize (partnering with BlackRock’s BUIDL fund), Franklin Templeton, Hashnote, and Open Eden.

Private Credit: Loans provided by non-bank financial institutions to small and medium-sized businesses.

Morpho Labs’ integration with Coinbase’s KYC system to support lending pairs for Centrifuge, Midas, and Hashnote signals a growing trend of incorporating RWA into DeFi.

Centralized Exchanges (CEXs)

Market Share of Spot and Derivatives TradingMarket Share of Spot and Derivatives Trading Volume. Source: The Block

Market Share of Spot and Derivatives TradingMarket Share of Spot and Derivatives Trading Volume. Source: The Block

Capital is migrating from CEXs to DEXs through increased spot and derivatives trading activity. DEX market share in both segments has surged since late 2023, with spot trading reaching a new high of over 15%. Furthermore, CEXs are actively bridging the gap to on-chain activity by launching Layer-2 appchains like Coinbase’s Base and Kraken’s Ink.

Bitcoin

Wrapped Bitcoin (WBTC) and Coinbase Wrapped Bitcoin (cbBTC) Market CapMarket capitalization of wrapped Bitcoin (WBTC) and Coinbase Wrapped Bitcoin (cbBTC). Source: Dune

Wrapped Bitcoin (WBTC) and Coinbase Wrapped Bitcoin (cbBTC) Market CapMarket capitalization of wrapped Bitcoin (WBTC) and Coinbase Wrapped Bitcoin (cbBTC). Source: Dune

Bridging Bitcoin to DeFi has gained significant traction, particularly with Coinbase’s launch of cbBTC. Within a month, cbBTC’s market capitalization reached $500 million, primarily utilized within DeFi protocols on Ethereum and Base. This trend suggests the potential for billions of dollars in Bitcoin to enter the DeFi ecosystem. Currently, WBTC and cbBTC represent a small fraction of Bitcoin’s total market capitalization, highlighting the untapped potential.

3. Proven Product-Market Fit

DeFi Protocol Fees and Token IncentivesFees and User Incentive Tokens for Aave, Uniswap, and Lido. Source: Artemis

DeFi Protocol Fees and Token IncentivesFees and User Incentive Tokens for Aave, Uniswap, and Lido. Source: Artemis

DeFi has consistently demonstrated product-market fit, maintaining strong user demand despite reduced token incentives. Leading protocols like Aave (lending), Uniswap (DEX), and Lido (liquid staking) continue to generate substantial fees while reducing token incentives. This contrasts sharply with other crypto narratives like NFTs and Telegram Games, which have struggled to maintain sustained user engagement.

Performance of NFTs and Telegram Game – CitizenPerformance Comparison: NFTs and Telegram Game (Citizen). Source: Dune

Performance of NFTs and Telegram Game – CitizenPerformance Comparison: NFTs and Telegram Game (Citizen). Source: Dune

Two Key Challenges for DeFi

1. Interest Rate Volatility and Liquidity Fragmentation

While declining interest rates can attract capital to DeFi, yield volatility remains a challenge. DeFi yields fluctuate based on market conditions and protocol-specific factors. Moreover, liquidity fragmentation across multiple blockchains can exacerbate yield fluctuations and reduce capital efficiency. Solutions like Aave’s cross-chain liquidity layer and Uniswap’s integration with Superchain aim to address this issue, but their implementation is still pending.

2. Unproven Efficacy of New Models

Modular DeFi

The shift towards Modular DeFi, characterized by customizable and composable components, holds promise but lacks proven efficacy. While established protocols like MakerDAO (now Sky Money), Uniswap (V4), and Aave (V4) are embracing modularity, their implementations are still in early stages. Smaller protocols like Morpho and Euler have successfully implemented modular designs, but their impact on overall market activity remains limited.

Loan volume on Morpho Labs. Source: Token Terminal

Loan volume on Morpho Labs. Source: Token Terminal

Restaking and BTCFi

Restaking, which allows users to leverage staked assets for additional yield, has achieved significant TVL growth but faces challenges in sustaining long-term yield generation. Similarly, BTCFi, focused on building a Bitcoin-centric DeFi ecosystem, remains a relatively small market segment due to limited adoption and lack of differentiation from Ethereum-based DeFi.

Restaking TVL. Source: Dune

Restaking TVL. Source: Dune

BTCFi TVL. Source: Coinmarketcap

BTCFi TVL. Source: Coinmarketcap

Conclusion

DeFi remains a fundamental building block of the crypto market. While established models have proven their viability, new innovations face challenges in demonstrating long-term effectiveness. The influx of capital from traditional finance, RWA, CEXs, and Bitcoin, coupled with declining interest rates, could ignite a new wave of DeFi growth. However, the success of this resurgence hinges on overcoming challenges related to yield volatility, liquidity fragmentation, and the maturation of emerging DeFi models. The future of DeFi is bright, but its path to widespread adoption remains a journey of continuous innovation and adaptation.