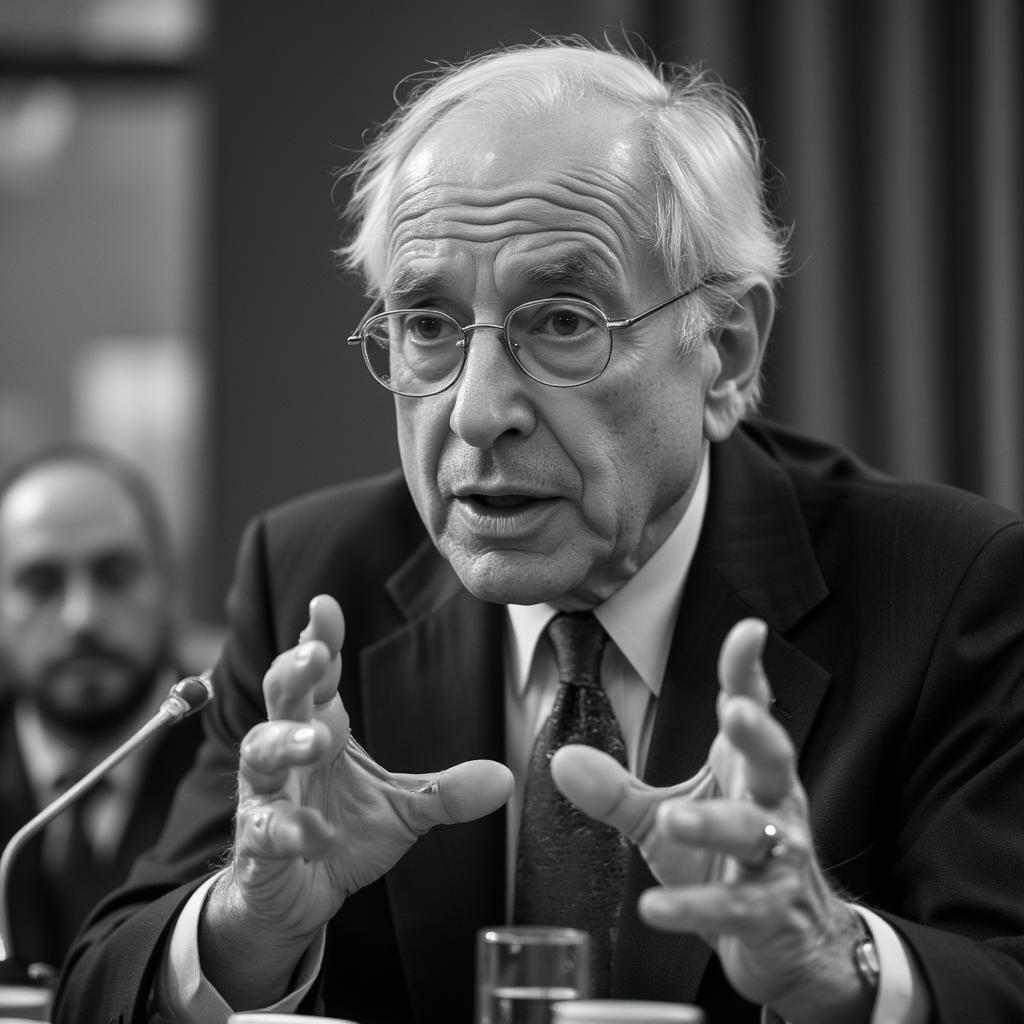

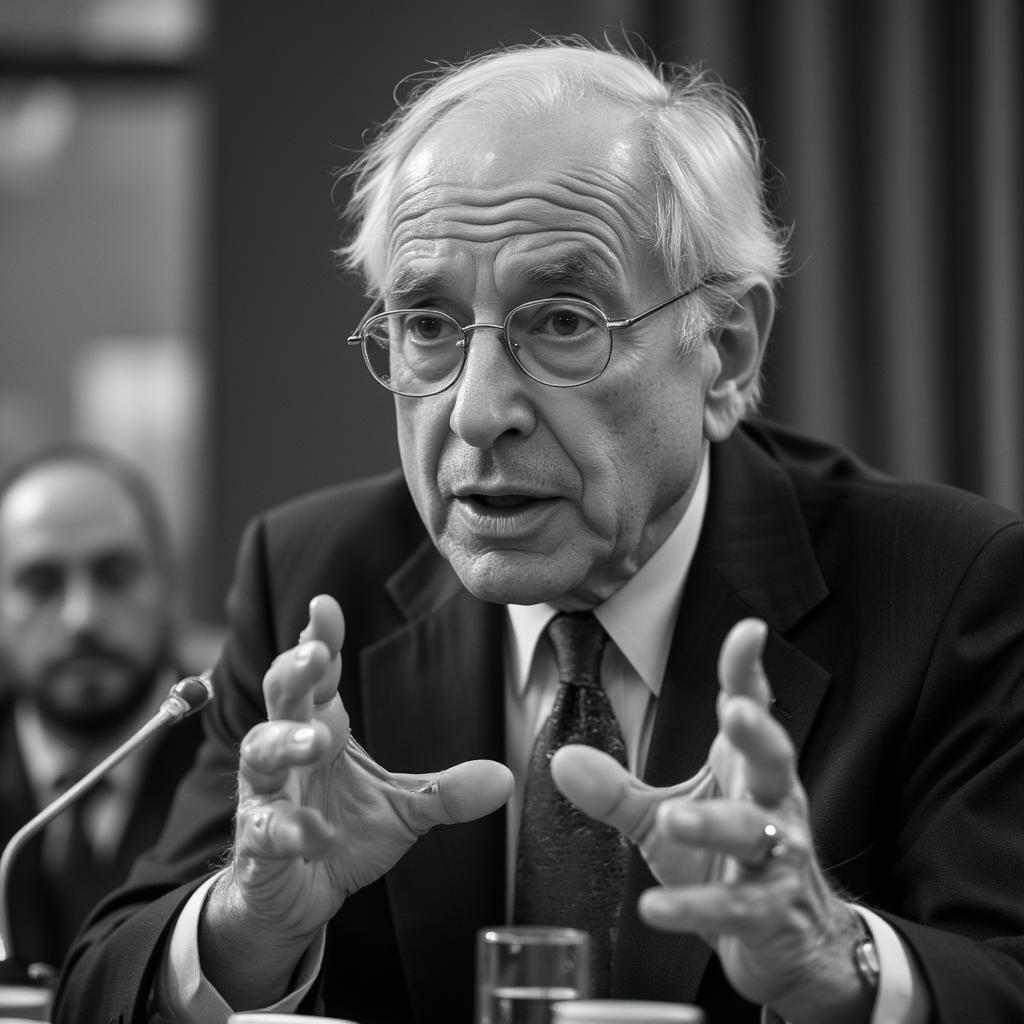

Milton Friedman, a name synonymous with free-market economics, remains one of the most influential economists of the 20th century. His groundbreaking work on consumption analysis, monetary history, and the stabilization policy earned him the 1976 Nobel Memorial Prize in Economic Sciences. More than just an academic, Friedman was a public intellectual, advocating for policies that championed individual liberty and limited government intervention. His ideas fundamentally reshaped economic thought and continue to spark debate today.

Born in Brooklyn, New York, in 1912 to immigrant parents, Friedman’s early life was marked by both academic excellence and a keen awareness of economic hardship. He graduated from Rutgers University in 1932, earning a scholarship to the University of Chicago for graduate studies in economics. This marked the beginning of a lifelong association with the Chicago School of Economics, a hub for free-market thinking. After completing his doctorate at Columbia University in 1946, he returned to Chicago, where he spent the majority of his distinguished career.

Friedman’s early work focused on consumption analysis. His 1945 book, “Income from Independent Professional Practice,” co-authored with Simon Kuznets, analyzed the income disparity between physicians and dentists. His most significant contribution in this area was the permanent income hypothesis, which argued that consumption is determined by long-term expected income, rather than current income. This theory revolutionized the understanding of consumer behavior and had significant implications for macroeconomic policy.

During the 1950s and 1960s, Friedman’s focus shifted towards monetary economics. He challenged the prevailing Keynesian orthodoxy, arguing that government intervention, particularly through fiscal policy, was often ineffective and even counterproductive. He famously asserted that “inflation is always and everywhere a monetary phenomenon,” attributing inflation to excessive growth in the money supply. His monumental work, “A Monetary History of the United States, 1867–1960,” co-authored with Anna Schwartz, provided empirical evidence for this claim, demonstrating the crucial role of monetary policy in shaping economic outcomes.

Milton Friedman's Impact on Monetary Policy

Milton Friedman's Impact on Monetary Policy

Friedman’s advocacy for free markets extended beyond academia. He was a passionate defender of individual liberty and a staunch critic of government intervention in the economy. He argued that free markets were the most effective mechanism for allocating resources and promoting economic growth. He believed that government’s role should be limited to protecting property rights, enforcing contracts, and fostering a stable monetary framework.

His popular 1962 book, “Capitalism and Freedom,” outlined his vision for a free society, advocating for policies such as school vouchers, a negative income tax, and the abolition of occupational licensing. These ideas, considered radical at the time, sparked widespread debate and helped to reshape the political landscape. He later served as an advisor to President Ronald Reagan, whose economic policies reflected Friedman’s free-market principles.

Friedman’s influence on economic thought is undeniable. His work challenged conventional wisdom, sparked intellectual debate, and profoundly shaped economic policy. His emphasis on individual liberty, free markets, and the importance of monetary policy continues to resonate with policymakers and economists today. He left a lasting legacy as a visionary leader who championed free markets and individual liberty, leaving an indelible mark on the world of economics and beyond.

His later years were marked by continued scholarship and public engagement. He remained active in public discourse, writing op-eds, giving lectures, and participating in debates until his death in 2006. His ideas continue to be studied and debated, solidifying his place as one of the most important economic thinkers of the 20th century.