A graph showing economic trends

A graph showing economic trends

Table Content:

Recent issues with data accuracy from the Office for National Statistics (ONS) and the Bank of England (BOE) are raising concerns about potential policy missteps in a crucial period for the UK economy. These inaccuracies, coupled with global political volatility and a new fiscal target, increase the risk premium on UK assets, impacting investor confidence and potentially leading to higher borrowing costs.

Data Discrepancies Fueling Uncertainty

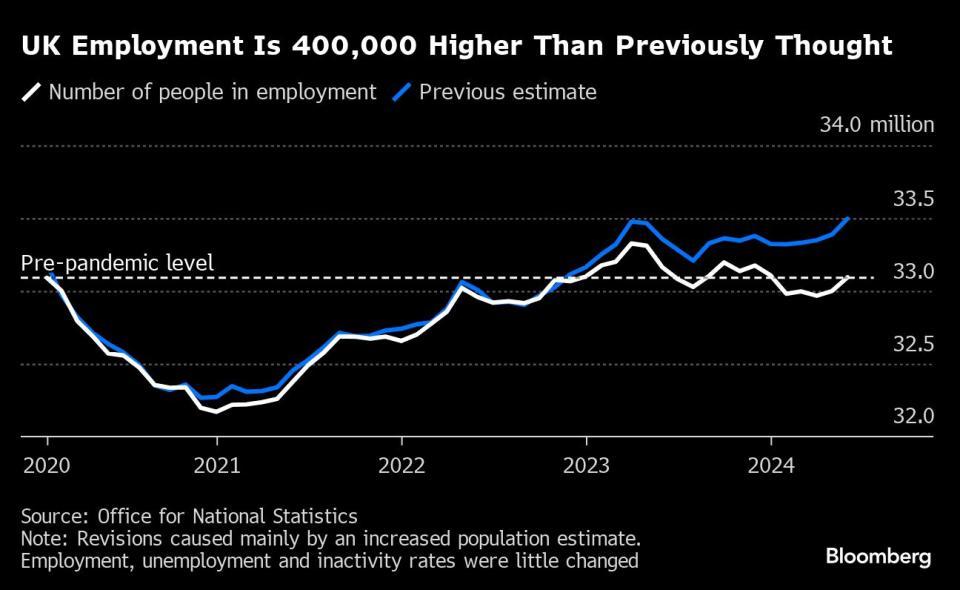

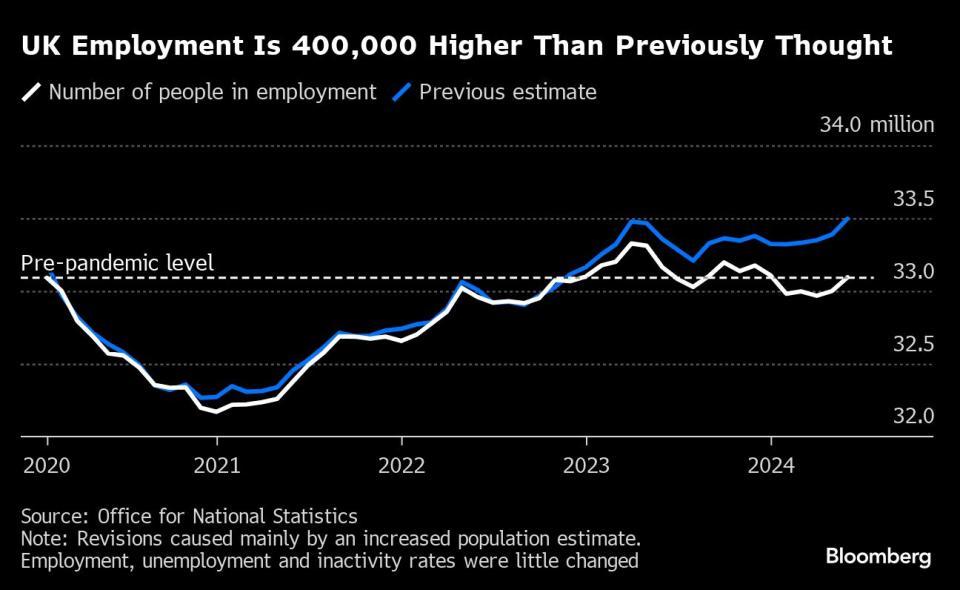

The current data problems affect key economic indicators. The Labour Force Survey (LFS), crucial for understanding employment trends, is currently considered unreliable, with conflicting reports on whether employment is rising or falling. This uncertainty complicates the BOE’s decision-making on interest rate adjustments, as the labor market’s inflationary pressure is a key factor.

Beyond monetary policy, inaccurate data impacts government spending on initiatives to address inactivity in the workforce. If the reported surge in long-term sickness is inaccurate, significant resources might be misallocated. Businesses also rely on accurate data for planning, with uncertainties around unemployment levels hindering banks’ ability to model mortgage arrears.

People working in an office setting

People working in an office setting

Institutional Challenges and Underinvestment

The BOE’s data infrastructure has been criticized as outdated and poorly maintained. This has raised questions about governance and oversight. Meanwhile, the ONS has been accused of slow responses to emerging data issues, preferring to suppress problems rather than address them proactively. The undercounting of migration further highlights the challenges faced by the ONS, impacting population projections crucial for planning housing, public services, and welfare spending.

The UK government also faces data challenges. The National Audit Office refused to sign off on government accounts due to missing local government data, impacting the assessment of public sector finances. An £18 billion error in the Office for Budget Responsibility’s calculation of the debt-reduction rule further underscores the widespread nature of these concerns.

Implications for Investors and Policymakers

These data discrepancies have broad implications. For investors, the increased risk premium on UK assets reflects the uncertainty surrounding the country’s economic outlook. For policymakers, unreliable data makes it difficult to make informed decisions on crucial issues such as interest rates, government spending, and fiscal planning. The lack of accurate and timely data hinders effective policymaking and creates an environment of uncertainty for both investors and the broader economy. Addressing these data quality issues is crucial for restoring confidence in the UK economy and ensuring sound policy decisions.

Conclusion: The Need for Data Integrity

The UK’s current data challenges underscore the critical need for accurate and reliable information in economic policymaking and investment decisions. Addressing the issues within the ONS and BOE, investing in modern data infrastructure, and improving data collection methodologies are crucial steps towards restoring confidence and ensuring the long-term health of the UK economy. The accuracy of economic data is fundamental to sound decision-making, and the current situation demands urgent action.