After an eight-month wait, Puffer Finance, a project allowing users to deposit ETH in exchange for Puffer points, finally unveiled its tokenomics. With a total supply of 1 billion PUFFER tokens, the distribution includes: 7.5% for Season 1 airdrop, 5.5% for Season 2 airdrop, 20% for early contributors and advisors, 40% for ecosystem and community development, 1% for the Protocol Guild, and a substantial 26% allocated to investors. The initial circulating supply at Token Generation Event (TGE) was 102.3 million PUFFER, representing 10.23% of the total supply.

Table Content:

The airdrop, employing a tiered system favoring smaller accounts with a minimum allocation for all participants, ultimately disappointed early supporters. Many users with significant point balances received only the minimum 70 PUFFER (approximately $20), netting a meager ~$8 after transaction fees. Even prominent figures like Justin Sun, who staked 59,000 ETH (approximately $151 million), received only 3.9 million PUFFER (approximately $1.32 million), representing a paltry ~1% return over eight months, excluding ETH price depreciation.

The Waning Allure of EigenLayer and Liquid Restaking

Puffer Finance, backed by Binance Labs and an early entrant in the EigenLayer liquid restaking ecosystem, was highly anticipated. However, recent token performance across this sector suggests a cooling of investor enthusiasm, particularly among retail participants.

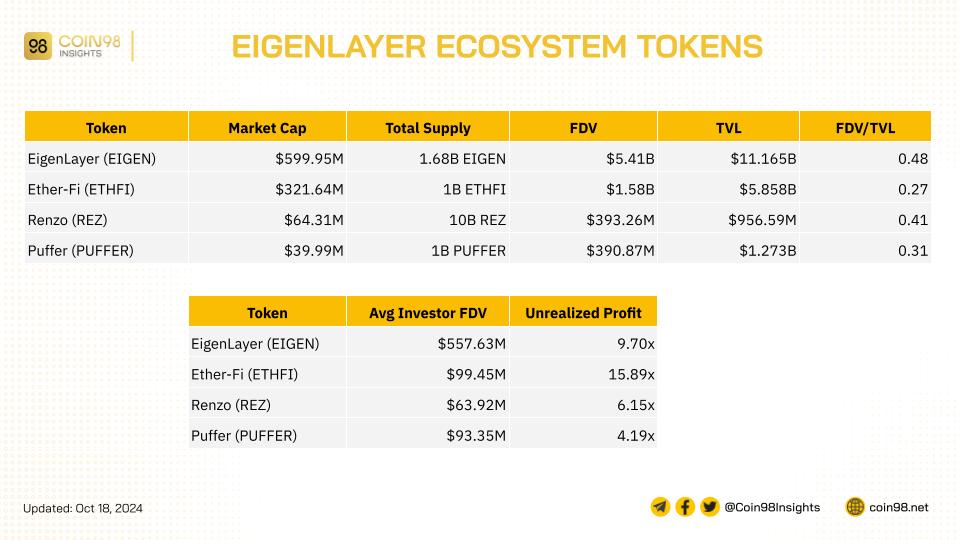

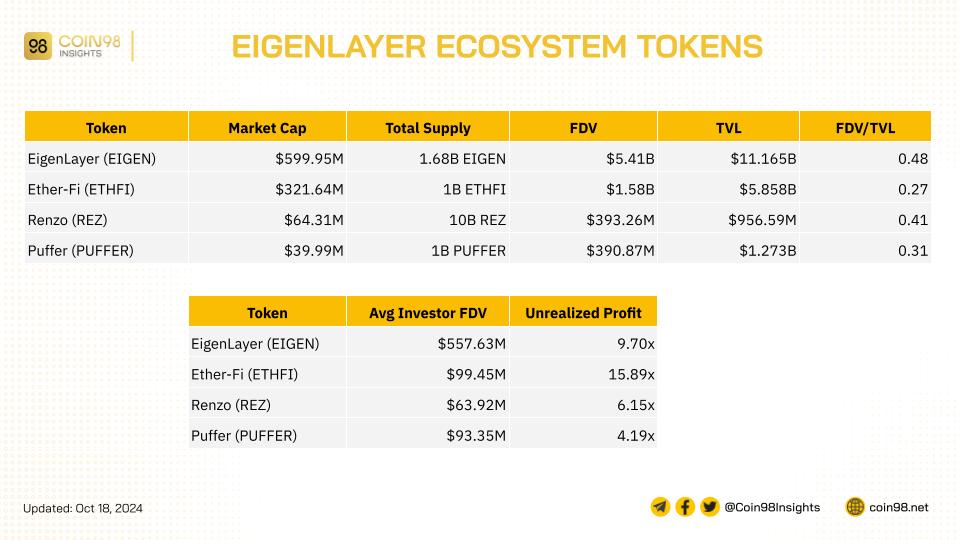

Most liquid restaking projects have opted for low initial token unlocks, resulting in a smaller circulating market capitalization compared to the Fully Diluted Valuation (FDV). This high FDV, low float scenario has raised concerns among investors wary of previous market trends.

Token metrics of EigenLayer ecosystem projects

Token metrics of EigenLayer ecosystem projects

Excluding replicated ETH on liquid restaking platforms, subsequent projects exhibit higher FDV/TVL ratios compared to the pioneering Etherfi. A lower FDV/TVL ratio generally suggests undervaluation relative to underlying assets.

Given the significant venture capital investments in these projects, calculating the average investor FDV reveals diminishing returns. While Puffer and Etherfi share a similar average investor FDV, the realized profit disparity is stark. Subsequent projects show progressively lower returns, even for institutional investors. Notably, EigenLayer itself, despite its central role, trails Etherfi in profitability. This trend underscores the waning appeal of restaking, despite comparable project quality.

This decline is further evidenced by the decreasing ETH and TVL on EigenLayer since its peak in late June. Most Liquid Restaking Tokens (LRTs) have lost market share, with the exception of Etherfi’s eETH.

Liquid Restaking Token dynamics on EigenLayer

Liquid Restaking Token dynamics on EigenLayer

Declining Interest in EigenLayer Ecosystem Tokens

The underwhelming performance of EIGEN post-TGE further contributes to the diminished interest in the EigenLayer ecosystem. Two primary factors contribute to this decline:

1. Complex Token Utility:

EigenLayer’s EIGEN, positioned as a Universal Intersubjective Work Token, presents a complex and novel concept challenging for newcomers to grasp. In essence, EIGEN facilitates mediation and resolution of Intersubjective Faults within Actively Validated Services (AVS), technical issues largely irrelevant to retail investors.

EigenLayer token use case model

EigenLayer token use case model

EIGEN’s value hinges on the growth of the AVS ecosystem, as revenue generated directly benefits EIGEN stakers. However, current AVS projects lack compelling traction, requiring a significant catalyst for broader adoption. Similarly, other LRTs offer limited utility beyond governance rights.

2. Selling Pressure from Airdrops:

Like many airdropped tokens, EIGEN faced substantial selling pressure upon listing due to a lack of immediate utility for retail recipients. With 46% of the initial 185 million EIGEN supply distributed via airdrops, and significant allocations to institutional investors and crypto whales, selling pressure was exacerbated.

The Future of Restaking

Following EigenLayer’s trajectory, users are exploring newer restaking platforms like Symbiotic and Karak. Symbiotic, despite quickly reaching its deposit cap with over $1.6 billion in TVL, boasts a lower valuation, smaller funding rounds, and a smaller market capitalization compared to EigenLayer.

TVL of different restaking projects

TVL of different restaking projects

Replicating EigenLayer’s success will require significant differentiation. While Symbiotic focuses on DeFi use cases, its market approach remains largely similar, raising questions about its long-term prospects. The restaking landscape faces challenges, and innovative approaches are crucial for sustained growth and investor confidence.