The US steel industry is bracing for potential price increases following President Trump’s announcement of tariffs on imports from Canada and Mexico. While the tariffs were temporarily suspended pending negotiations, the initial announcement sent ripples through the market, impacting steel prices and raising concerns for businesses reliant on imported steel.

Several US steel companies saw price increases even before the official tariff announcement. Riverdale Mills, a Massachusetts-based manufacturer of wire fencing, received notice of price hikes from its domestic steel suppliers. CEO James Knott expressed concern over the rising cost of steel, which constitutes two-thirds of Riverdale’s production costs. Knott highlighted the challenge of competing with foreign rivals when domestic steel prices are significantly higher. He sources approximately 80% of his wire rod from Canada due to lower shipping costs compared to domestic suppliers.

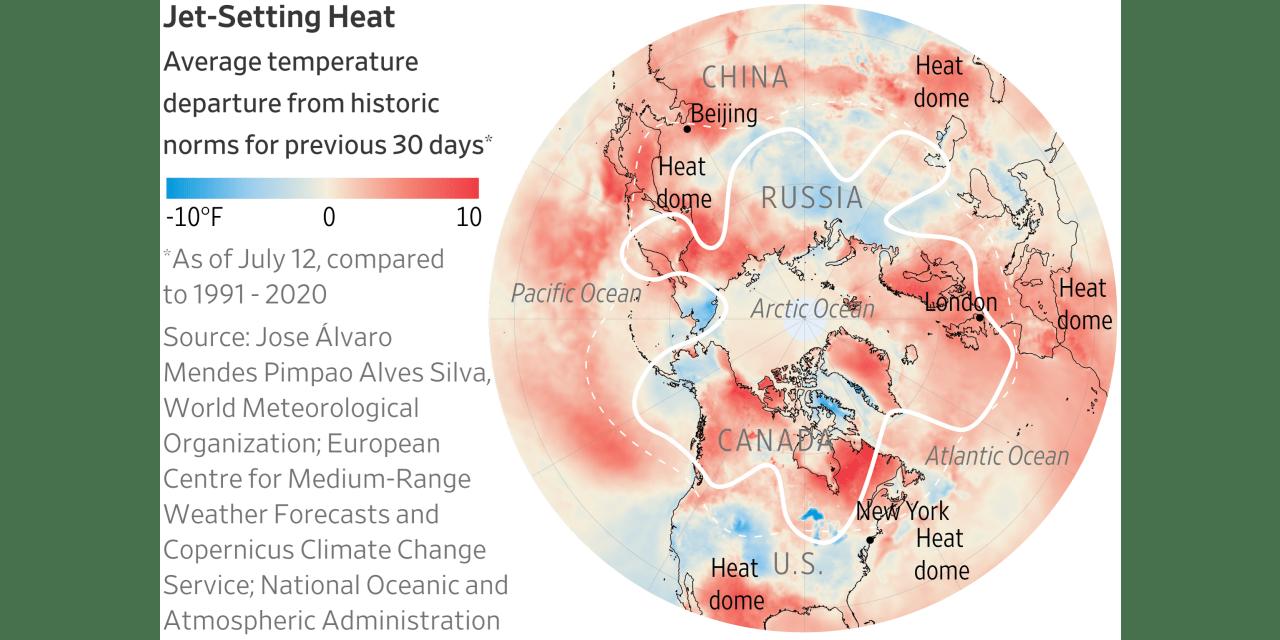

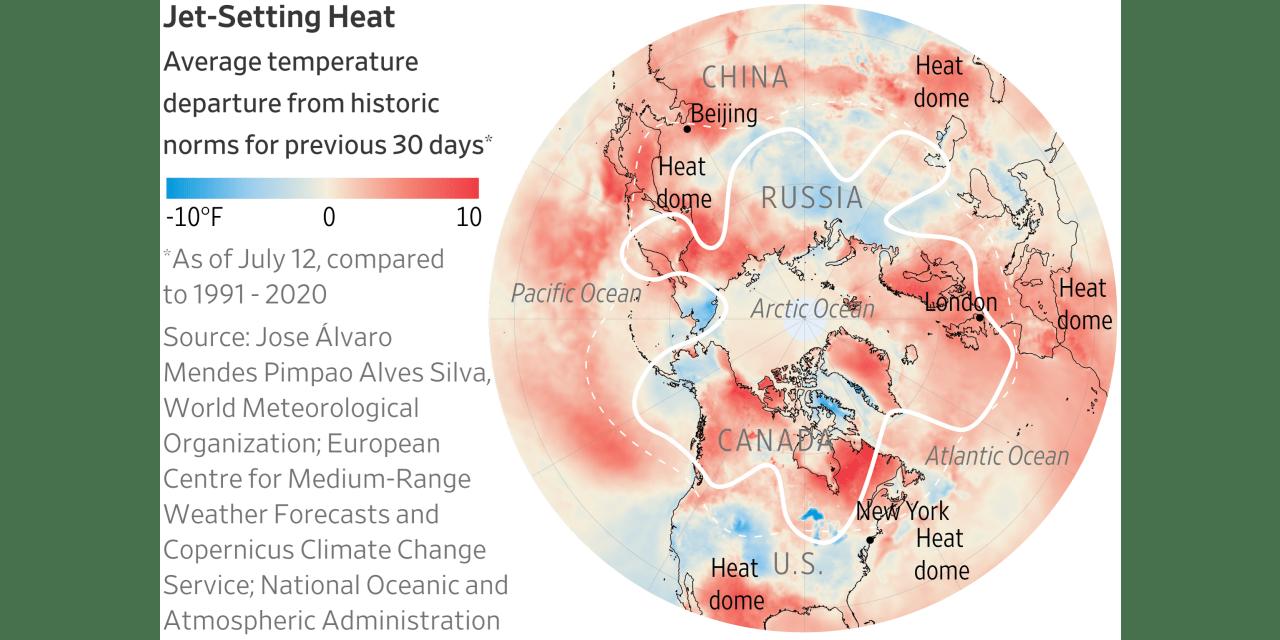

The proposed 25% tariffs on all imports from Mexico and Canada, along with a 10% tariff on imports from China, were intended to address illegal immigration and illicit fentanyl shipments. However, the move sparked fears of a trade war, with Canada and Mexico vowing retaliatory tariffs.

For US steelmakers, the tariffs promised increased pricing power by effectively raising the cost of foreign steel. This could enable domestic companies to raise their own prices. Canada and Mexico are major steel suppliers to the US, accounting for 35% of all imported steel in 2024. These countries were initially included in the steel and aluminum tariffs imposed in 2018 but were later exempted after negotiating a new free-trade agreement.

US steel company executives have been vocal supporters of tariffs, urging their reinstatement to address what they perceive as unfairly priced foreign steel undermining the US market. They advocate for the elimination of tariff exemptions and duty-free import quotas.

Graph showing Canada and Mexico's share of US steel imports.

Graph showing Canada and Mexico's share of US steel imports.

The potential impact on consumers is also a concern. Higher steel and aluminum prices could lead to increased costs for durable goods like appliances and automobiles, as well as consumer products with aluminum packaging. Ralph Hardt, owner of Belleville International, a manufacturer of valves and components, anticipates price increases across the board due to the tariffs.

Following the tariff announcement, U.S. Steel announced a $50-a-ton price increase for flat-rolled steel, while Nucor raised its price by $25 a ton. The tariffs on aluminum from Canada and Mexico could result in a delivery surcharge on all aluminum transactions, potentially benefiting US aluminum companies that don’t have to pay the tariff but can collect a higher premium from customers.

Image depicting tariffs on Chinese imports.

Image depicting tariffs on Chinese imports.

The beverage industry, a significant consumer of aluminum, strongly opposed the 2018 aluminum tariffs, arguing that beer and soda makers paid inflated delivery premiums. Canada, the largest supplier of smelter-made aluminum to the US, could divert shipments to avoid US tariffs.

The US steel industry experienced its weakest year since 2020, with spot market prices for coiled sheet steel remaining below $700 for months. Several attempts to raise prices last year failed due to weak demand. A significant increase in US steel production capacity, spurred by the initial Trump-era tariffs, has contributed to the current market dynamics.

A graph illustrating the growth of US steel production capacity.

A graph illustrating the growth of US steel production capacity.

Steel executives believe further tariffs will restrict imports and stabilize the US steel market. Leon Topalian, CEO of Nucor, anticipates that companies engaging in unfair pricing practices will face consequences.

In conclusion, the proposed tariffs on Canadian and Mexican steel and aluminum imports have created uncertainty in the market, leading to price increases and concerns about potential trade wars. While the tariffs are currently on hold, the situation warrants close monitoring as it could significantly impact both businesses and consumers.